The convergence of psychedelics and mental health treatment is no longer a fringe curiosity — it’s becoming one of the most watched and strategically important developments in modern neuropsychiatry.

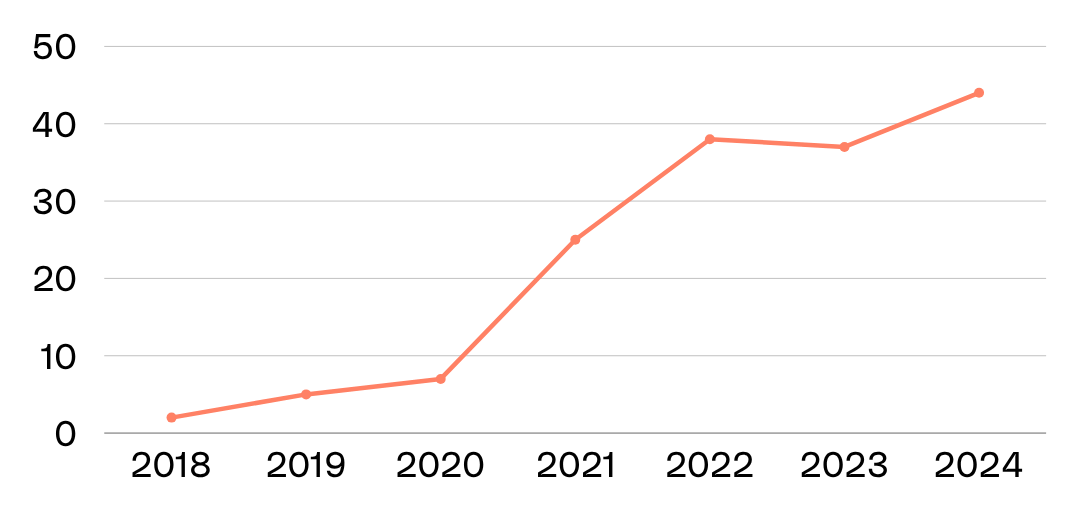

At Theia Insights, our Industry Classification (TIIC) and Thematic Intelligence platform reveal a sharp increase in the number of companies focused on this crossover. In 2018, only two companies were meaningfully active in both psychedelics and mental health. By 2024, that number had grown to 44 — driven by a wave of scientific validation, regulatory momentum, and investor attention.

The big shift? The field is now moving from proving efficacy to proving scalability.

A Maturing Market with Clear Business Models

From our analysis, we see a split in how companies are approaching the opportunity — each with distinct strengths and risks. These archetypes include:

Indication Leaders – Companies like COMPASS Pathways are laser-focused on bringing a single therapy (e.g. psilocybin for treatment-resistant depression) to market, betting big on being first with FDA approval.

Platform De-riskers – Firms such as Atai Life Sciences take a diversified approach, developing multiple compounds across a variety of mental health conditions, effectively spreading the risk of clinical failure.

Next-Gen Innovators – Players like Cybin and MindMed are reengineering classic psychedelics into novel, patentable molecules that are shorter-acting, more scalable, and easier to integrate into modern healthcare settings.

Integrated Ecosystem Builders – Companies like Awakn Life Sciences are pairing drug development with specialised clinic infrastructure, aiming to control the full treatment journey from molecule to patient delivery.

This range of strategies signals the emergence of a real market. These aren’t science experiments — they’re business models.

The Real Battleground: Execution at Scale

Early results have been promising. COMPASS Pathways, for instance, is advancing its Phase 3 program for COMP360 psilocybin therapy with Breakthrough Therapy Designation from the FDA. MindMed has shown compelling Phase 2b data in Generalized Anxiety Disorder with its MM-120 compound. GH Research, meanwhile, is developing fast-acting DMT treatments that can be administered in under 90 minutes — addressing the cost and resource burden of current psychedelic protocols.

But for all these scientific advances, commercial viability depends on three critical execution challenges:

Session Time – Long therapy durations (e.g. 6–8 hours for psilocybin) limit patient throughput and drive up costs. Companies engineering “procedural psychedelics” with shorter acting compounds may have an advantage.

IP Strength – With many classic psychedelic molecules in the public domain, companies are racing to patent novel analogs, delivery systems, or crystalline forms. Deuteration (used by Cybin) and proprietary inhalers (like GH Research’s) are emerging strategies.

Payer Buy-In – Reimbursement is a major hurdle. To win payer support, companies must demonstrate not just clinical efficacy but long-term cost savings and reduced healthcare utilization.

2025–2026: A Pivotal Period

The next 12–18 months are set to define the future of this field.

Several late-stage clinical trials are approaching major milestones, including:

COMPASS Pathways' Phase 3 results in TRD,

MindMed’s Phase 3 launch for anxiety,

Cybin’s and GH Research’s progression toward pivotal trials of short-acting treatments.

Regulatory bodies are also moving. The FDA has already granted Breakthrough Therapy Designations to multiple programs. The DEA will soon face pressure to reschedule specific psychedelic compounds upon approval — decisions that will directly impact commercial rollout.

Meanwhile, M&A is heating up. Larger pharmaceutical players are eyeing this space closely. With many emerging companies operating under tight budgets and high execution risk, those with strong IP, clean data, and scalable models could become attractive acquisition targets.

A Data-Driven Lens on the Psychedelic Landscape

At Theia Insights, we use dynamic classification and exposure modeling to help investors and institutions track these shifts. Our Thematic Indexing reveals not only who’s working in this space, but how — across delivery models, compound types, IP strategies, and regulatory positioning.

We believe the companies best positioned to succeed will be those that:

Own a defensible IP moat, ideally with novel molecules rather than formulations;

Build for clinical and logistical scalability, through shorter sessions or integrated delivery infrastructure;

Align with payer economics, proving that these therapies reduce long-term costs;

Reach pivotal milestones within the next 12–18 months, unlocking access and capital.

Closing Thoughts

Psychedelics for mental health are entering a defining chapter. The sector has moved beyond proof-of-concept. Now it’s about infrastructure, access, and commercial execution. Investors, strategists, and healthcare leaders must now ask not just “Does it work?” but “Who’s built to deliver?”

Get In Contact

press@theiainsights.comAbout Theia Insights

Theia Insights is a deep tech company based in Cambridge (UK), building foundational AI for the global investment community. We are a team of PhD scientists, engineers, mathematicians, and industry practitioners offering clients future-proof solutions in Industry Classification, Thematic Risk Models, and Portfolio Analytics. Named after the goddess of sight, Theia synthesises and distils vast amounts of financial information so investors can see more clearly. To learn more, visit www.theiainsights.com.