Power Thematic Structured Products and Client Baskets with Speed and Transparency

Theia enables investment banks to design, launch, and manage thematic baskets with confidence—from structured products and delta-one platforms to QIS strategies and client pitches. Our models make basket construction faster, more explainable, and adaptable to market shifts.

Register DemoPrecision Thematic Baskets In Seconds

Thematic Risk & Hedging Intelligence

Transparent & Explainable

Sales Acceleration

Complete Toolkit for Thematic Investing

Core Use Cases.

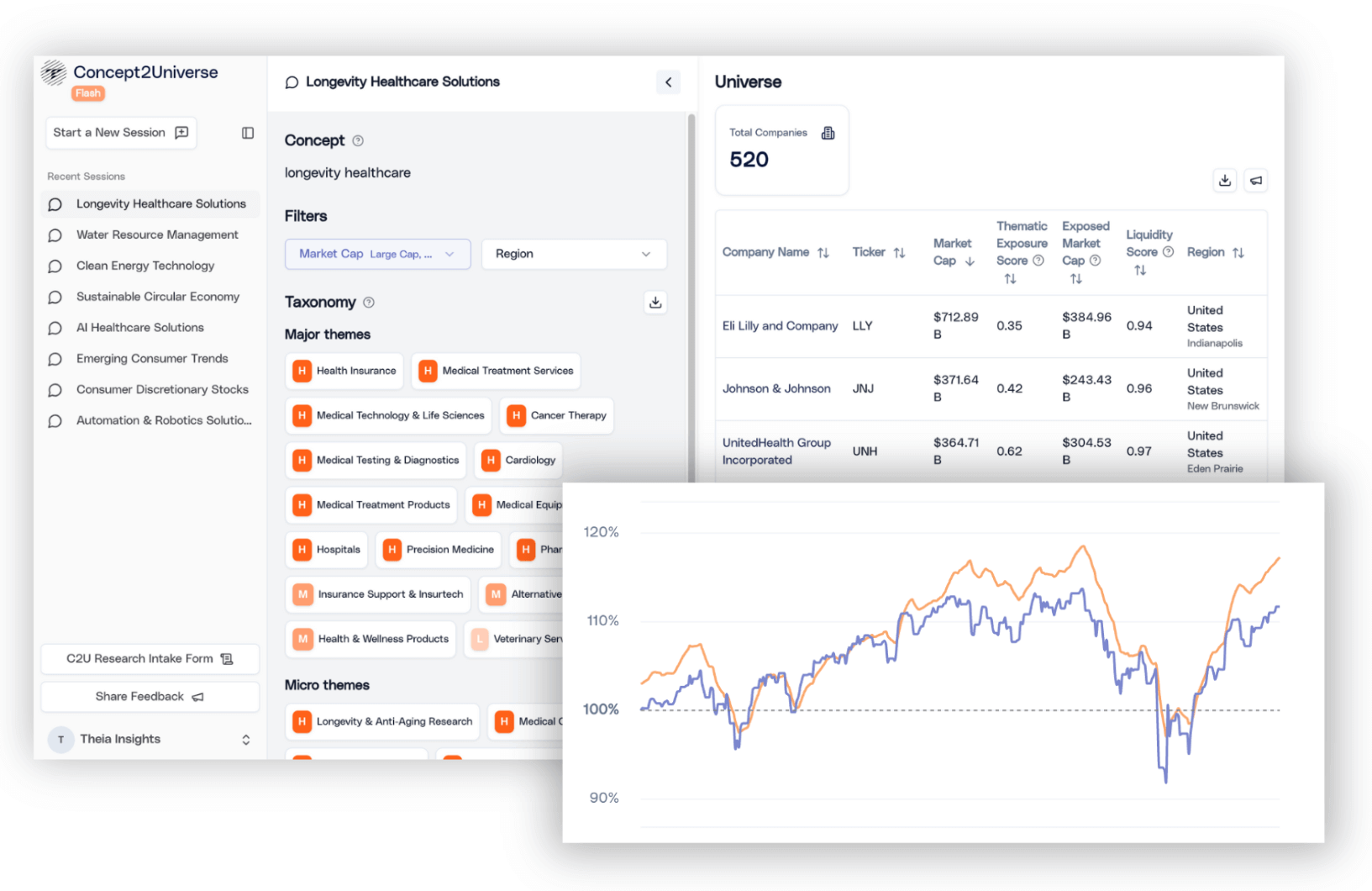

1. Build Thematic Baskets Fast, and Explain Them Clearly

- Turn client idea, CIO theme, or market trend into a transparent, investable basket in minutes.

- Filter and apply custom or Theia thematic weighting.

- Plug into delta-one and QIS platforms for structured notes, swaps, and overlays

Example:

Global "longevity healthcare" basket in seconds

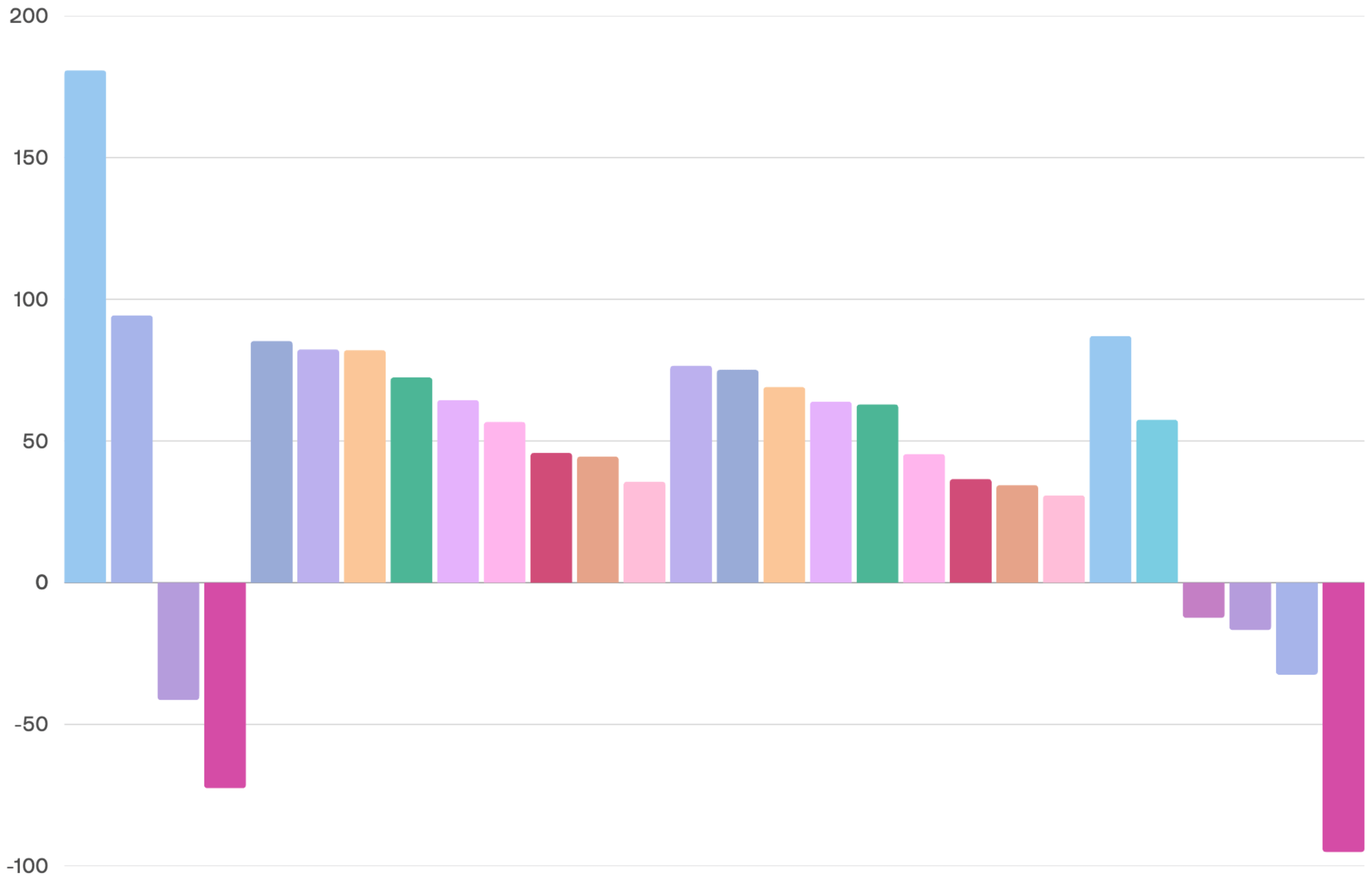

2. Thematic Risk, Hedging & Alpha Strategies

- Use TFM to quantify thematic risk and unintended exposures

- Build tilts and hedging baskets through a thematic lens.

- Use TFM, TWI, and TIIC to surface alpha signals.

Example:

"Digital Security" basket differentiation from standard tech

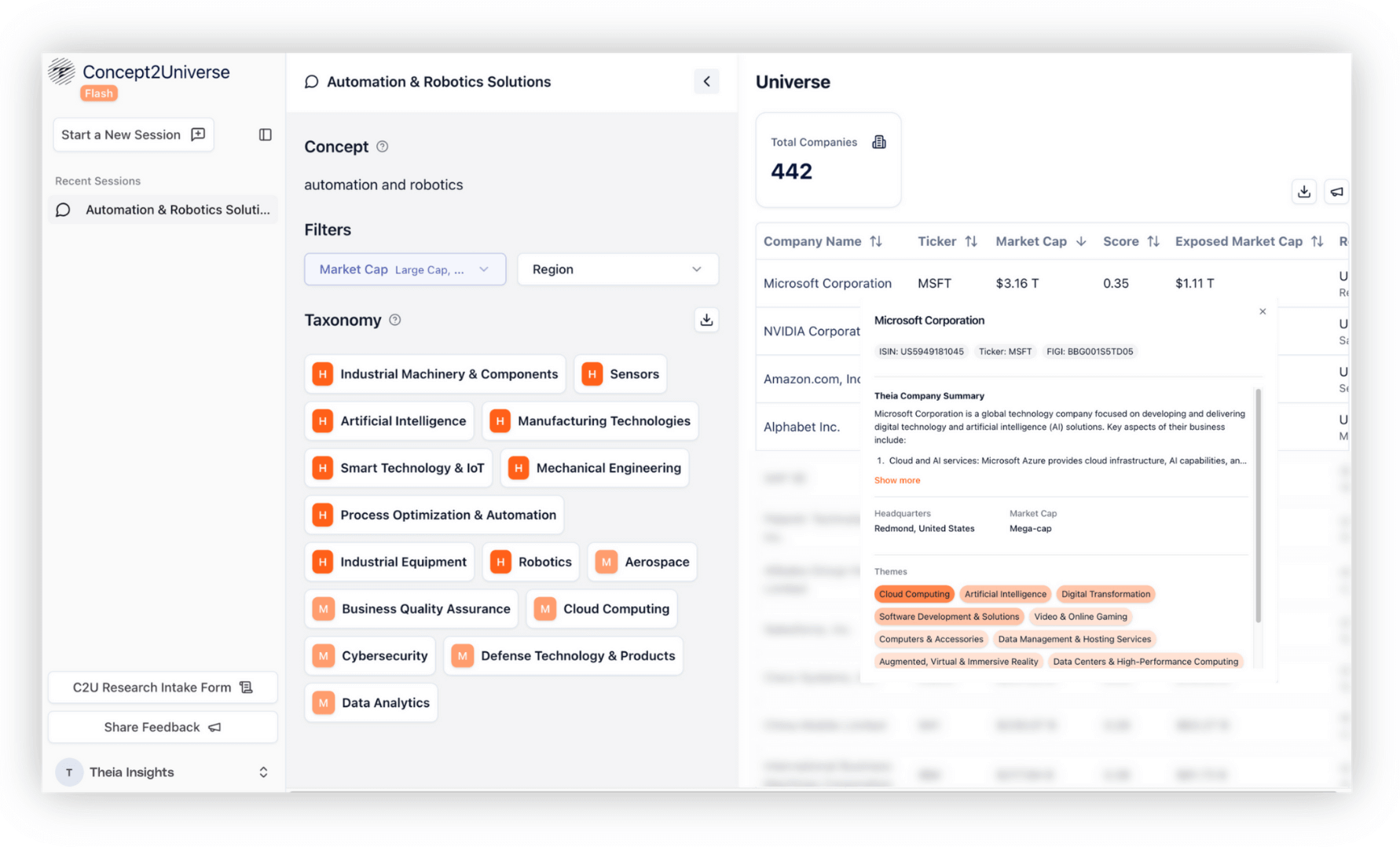

3. Equip Sales with Clarity, Credibility & Speed

- Generate explainable baskets in seconds with C2U Flash.

- Spot emerging or shifting themes before clients ask.

- Pitch with clarity - backed by exposure data and rationale.

Example:

Alert on "AI" and "Semiconductors" co-dependency in rotation models

Let's Build Better Thematic Products

Talk to us about powering your structured products platform, QIS strategies, or client-facing baskets—backed by explainable data and scalable tooling.

Request Demo