Extract Alpha from Themes. Control Risk with Precision.

Theia equips hedge & quant funds with advanced models and tools to uncover thematic alpha, decompose risk, and reveal what companies truly do. Track theme performance net of market and style factors, monitor hidden exposures, and construct precise hedges with clarity and speed.

Register DemoThematic Alpha Signals

Granular Exposure Decomposition

Precise Thematic Peers

Thematic Hedging & Risk Overlay

Complete Toolkit for Thematic Investing

Core Use Cases.

1. Thematic Alpha Signals

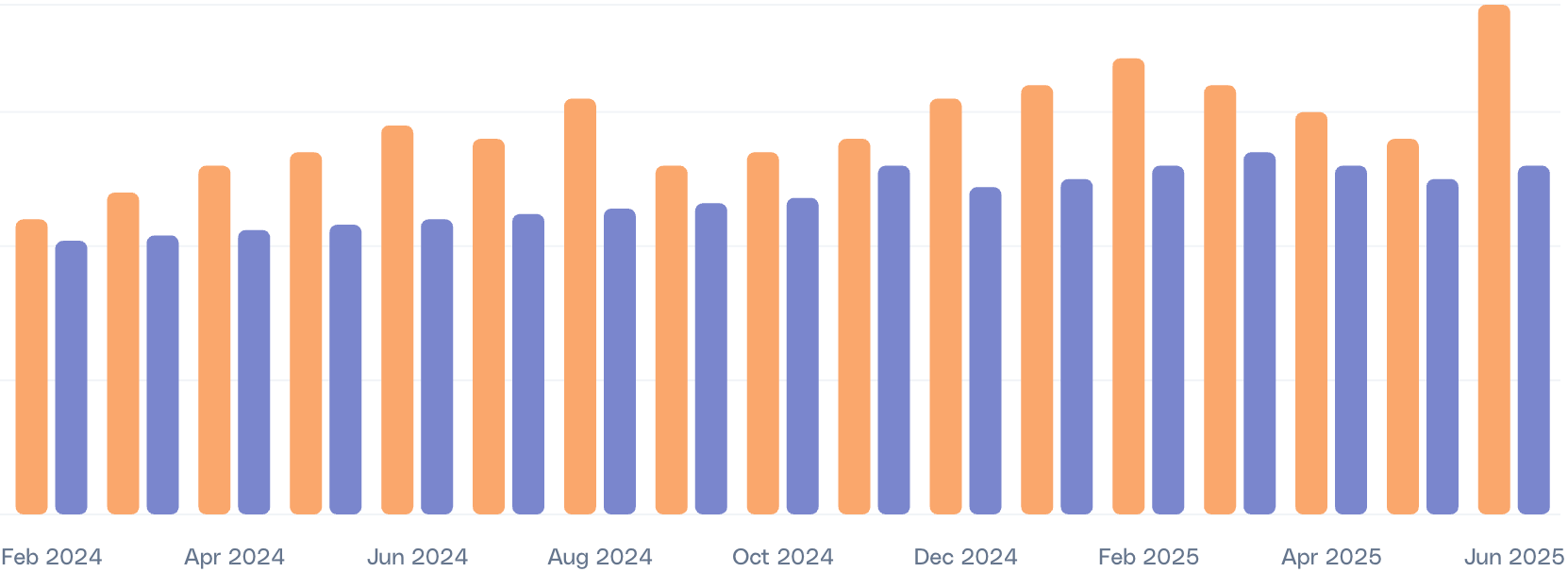

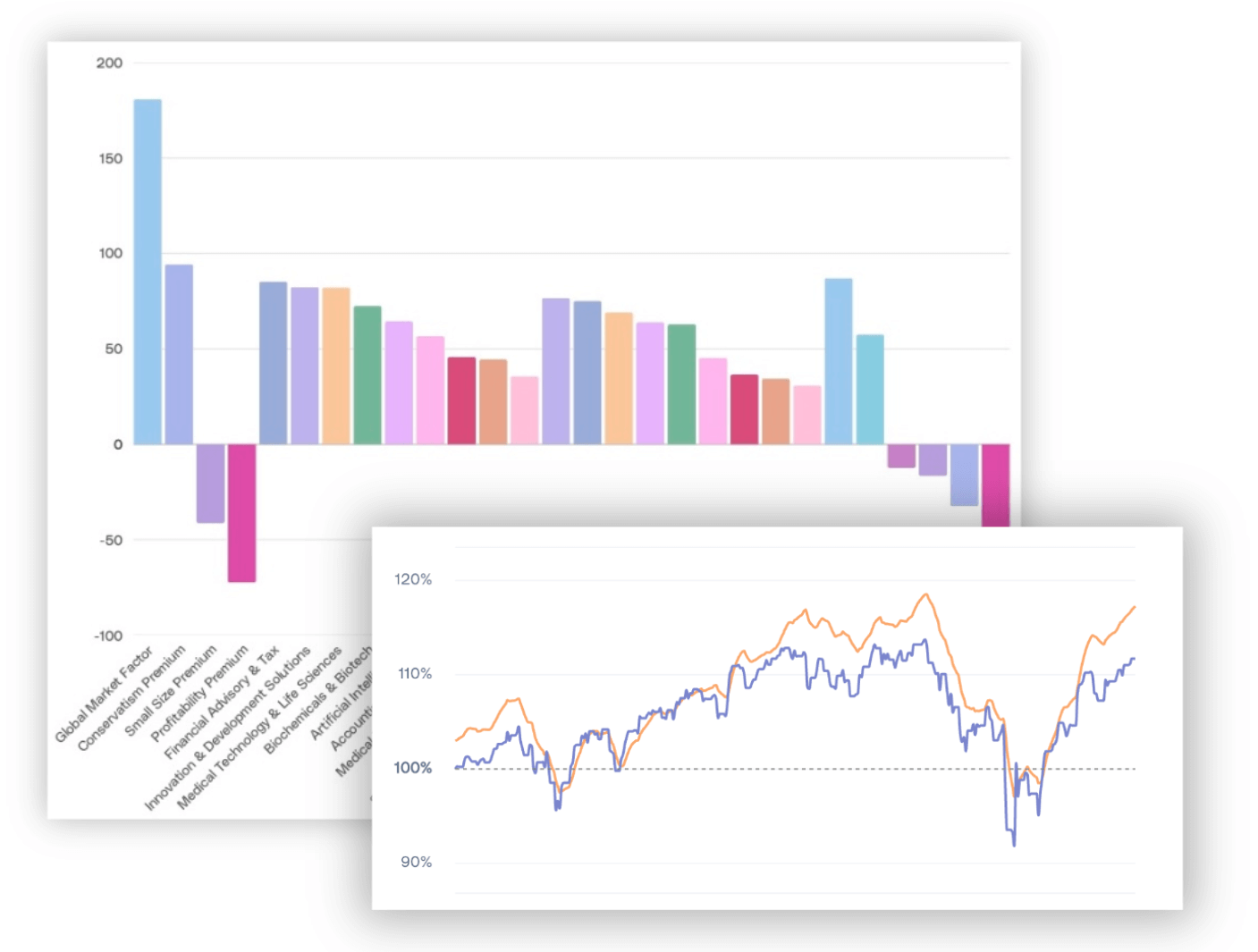

- Use TFM and TWI to identify themes generating alpha net of market and style factors

- Track relative performance and reversal signals across 200+ themes

- Construct long/short baskets or theme rotation strategies

2. Risk Control and Thematic Hedging

- Use TFM to flag correlated themes and unintended bets

- Monitor crowding, trend exhaustion, and reversals using TWI

- Construct theme-pure hedges or overlays using Theia baskets

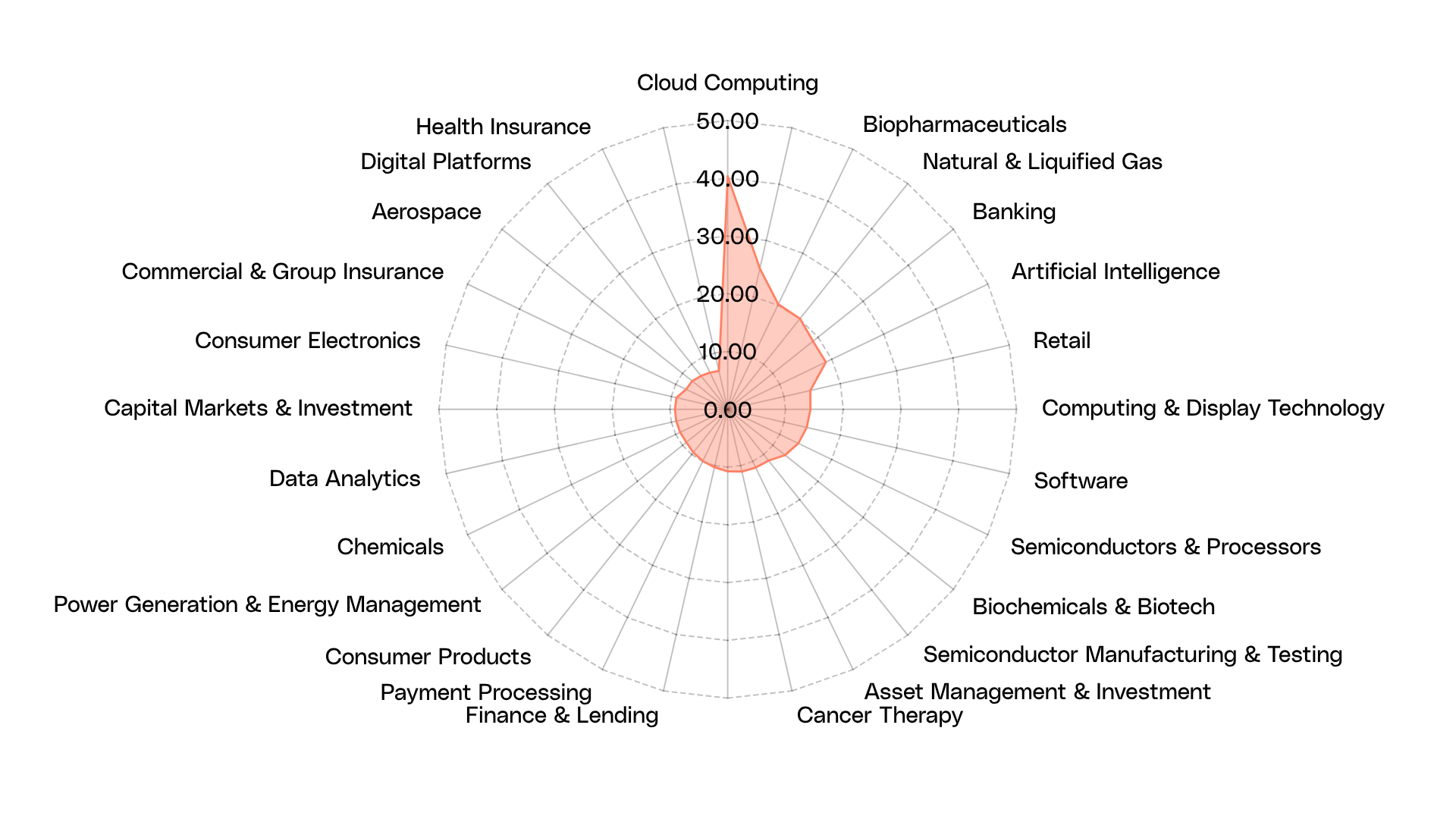

- Identify thematic peers using Thematic Comps to benchmark or rotate within a theme

3. Position and Portfolio Exposure Decomposition

- Use TIIC to decompose portfolio holdings by theme, industry, and sub-industry

- Spot hidden concentrations and understand true thematic exposures

- Improve transparency, attribution, and hedge design

Let's Talk Alpha and Risk.

Get in touch to explore how Theia can plug into your fund's workflow, from alpha models to risk overlays and beyond.

Request Demo