We publish in the first week of each month, covering the previous month’s thematic moves, catalysts, and momentum.

Welcome to the inaugural Theia Monthly Highlights - our fast, investable read on October 2025 across Theia’s thematic universe. This issue ranks the winners and laggards while tagging the catalysts behind them. It reveals where momentum gathered pace over October, highlighting trends that gained traction as the month progressed. Built on Theia Insights Industry Classification and thematic factor framework, it turns a noisy month into a clear map of opportunity.

October 2025 Performance Synopsis

Using global returns from October 1 to October 24

Technology and Energy Leaders

October delivered strong double-digit gains across technology and energy-focused portfolios, with Batteries & Energy Storage +19.29% leading all themes as the energy transition narrative gained momentum. The computing infrastructure space showed remarkable strength, with Data Centres & High-Performance Computing +15.01% surging, likely driven by continued AI infrastructure buildout and growing demand for processing power.

Digital Assets Rally

The cryptocurrency ecosystem experienced a notable rally, with Cryptocurrency & Digital Assets +12.59% climbing and Blockchain & Distributed Ledger Technology +11.66% advancing. This resurgence suggests renewed investor confidence in digital asset markets. Meanwhile, Quantum Technology +11.66% matched blockchain's performance, reflecting growing commercial interest in next-generation computing capabilities.

Healthcare Innovation

Healthcare innovation themes demonstrated solid performance, with Genomics & Gene Editing +10.00% and Precision Medicine +10.00% both delivering returns above 10%. The broader medical technology sector showed consistent mid-to-high single-digit gains, with Medical Testing & Diagnostics +8.00%, Medical Technology & Life Sciences +7.00%, and various medical equipment categories all posting positive returns between 4% and 8%. This suggests sustained investor appetite for healthcare innovation despite the more modest gains compared to technology leaders.

Industrial and Manufacturing Performance

Industrial and manufacturing themes occupied the middle tier, with most posting returns between 3% and 7%. Semiconductor Chips, Design & Manufacturing +7.77% gained solidly, while various industrial categories including Manufacturing Technologies +4.00%, Mechanical Engineering +3.50%, and Industrial Equipment +3.50% delivered steady but unspectacular returns in the 3-4% range. Materials plays like Aluminum +7.60% and Iron & Steel +4.52% showed relative strength.

Technology Sector Divergence

The technology sector displayed divergent performance, with infrastructure and hardware themes outpacing software and services. While Cloud Computing +4.72% and Artificial Intelligence +4.71% managed modest gains, Software Development & Solutions +3.16% lagged further. Cybersecurity +2.89% disappointed, and Data Analytics +1.34% struggled, suggesting investors favoured physical infrastructure over software capabilities this month.

Consumer and Retail Weakness

Consumer-facing themes generally underperformed, with most retail, hospitality, and consumer service categories posting flat to negative returns. Retail +0.58% managed minimal gains, while Hospitality & Accommodation -0.34% slipped and Restaurants, Bars & Cafes +1.76% eked out only modest returns. The weakness extended to consumer discretionary areas, with Toys & Games -0.74% down and Video & Online Gaming -1.88% falling.

Financial Services Struggles

Financial services themes struggled significantly, with traditional banking and investment categories posting losses. Retail & Commercial Banking -0.71% declined, Investment Banking -1.63% fell, and Private Equity -2.04% dropped. Insurance-related themes fared even worse, with Personal & Property Insurance -3.00% down and Commercial & Group Insurance -3.05% losing ground, suggesting concerns about the sector's near-term profitability or interest rate sensitivity.

Bottom Performers

The bottom of the performance spectrum was dominated by entertainment, media, and consumer discretionary themes. Multimedia & Video Content Production & Platforms -4.23% declined, Broadcast & Television Networks -4.29% fell, and Video & Audio Streaming -4.63% dropped. The worst performer was Gambling -6.46%, indicating significant sector-specific headwinds. Transportation services also struggled, with Taxis & Ride-Hailing -3.54% down and Vehicle Rental -4.40% declining, pointing to potential concerns about consumer spending on mobility services.

Best Performing Themes

Batteries & Energy Storage +19.29%

Affordable EV Market Expansion: Major announcements of truly affordable EVs under $30,000-$40,000 from GM (Chev Bolt) and Tesla (Model 3/Y Standard) signal market maturation and broader consumer accessibility, potentially driving volume growth expectations for the sector. [18, 32, 106]

Battery Supply Chain and Manufacturing Investment: Significant developments including US government equity stakes in lithium mining, GM's battery lab expansion, and Nvidia's $350M investment in battery recycling demonstrate strong institutional confidence in securing domestic battery supply chains and circular economy infrastructure. [3, 7, 116]

Grid-Scale Energy Storage Growth: Multiple large-scale battery storage projects and partnerships (Talen-Eos, Germany's 716 MWh facility) indicate accelerating demand for stationary energy storage applications beyond EVs, expanding the total addressable market for battery technology. [63, 86, 94]

Premium EV Technology Advancement: Ferrari's 1,000+ hp electric powertrain reveal and commitment to 2026 EV launch demonstrates that even ultra-luxury manufacturers are investing heavily in electric technology, validating the sector's long-term trajectory. [1, 4, 41]

Competitive Dynamics and China Factor: Analysis of China's dominance in clean energy exports and discussions of US competitiveness in battery technology highlight geopolitical factors driving domestic investment and policy support for the batteries and energy storage sector. [3, 79]

Data Centres & High-Performance Computing +15.01%

Massive Capital Deployment in AI Infrastructure: Big Tech committed $320 billion to capex focused on AI data centres, with specific mega-deals including OpenAI-Broadcom partnerships, OpenAI-AMD multi-billion dollar chip agreements, and a potential $25 billion Argentina project. This unprecedented spending validates the sector's growth trajectory and drove investor confidence. [25, 28, 81, 103, 139]

Explosive Physical Data Centre Expansion: Tangible evidence of buildout with 54 new facilities in Virginia alone (mostly Amazon), North Carolina's largest data centre under construction, Oracle-OpenAI's second Stargate facility in Texas, and Apple shipping AI servers from new Houston factory. This physical infrastructure growth demonstrates real demand beyond speculation. [13, 31, 124, 148]

Validation of Long-Term Investment Thesis: Morgan Stanley analysis projecting AI spending will pay for itself by 2028, reports showing data centres will consume 12% of North American electricity by 2040, and Microsoft showcasing operational massive Nvidia AI systems all provided analytical support that the infrastructure boom is sustainable and economically justified. [21, 75, 110]

Power and Energy Infrastructure as Growth Enabler: The sector's energy demands (OpenAI-AMD deal requiring 6 gigawatts, data centres becoming largest US power demand driver, Nvidia backing battery recycling) highlighted both challenges and the critical infrastructure investments needed to support continued expansion, creating opportunities across the value chain. [58, 110, 116, 142]

Competitive Dynamics Driving Innovation: Partnerships diversifying beyond Nvidia (OpenAI with Broadcom and AMD), competitive analysis between chip makers, and "circular" mega-deals between AI companies demonstrated a maturing, competitive market with multiple winners rather than concerns about monopolisation. [25, 81, 103, 136]

Cryptocurrency & Digital Assets +12.59%

Regulatory Relief and Institutional Legitimacy: Trump's pardon of Binance founder Changpeng Zhao removed significant regulatory overhang from the world's largest crypto exchange, signalling a more crypto-friendly administration. This was reinforced by major institutional moves including ICE's $2bn investment in Polymarket and ten major banks exploring stablecoin creation, validating crypto's integration into traditional finance. [5, 17, 15, 123]

Seasonal Momentum and Technical Strength: Bitcoin entered October, historically its strongest performing month, with positive momentum that drove initial gains. Despite mid-month volatility and liquidations, the seasonal pattern supported the overall 12.59% monthly return. [50, 51, 137]

Major Enforcement Actions with Mixed Impact: Multiple massive seizures ($13-15 billion in bitcoin) from fraud operations demonstrated both the scale of crypto crime and authorities' improving ability to track illicit activity. While highlighting security concerns, these actions also showed crypto's traceability and may have removed selling pressure from criminal actors. [8, 35, 45, 78]

High Volatility and Whale Activity: Significant whale movements including $340M short positions and $160M profits from shorting during downturns created substantial volatility. Bitcoin whale dormancy hitting monthly highs suggested profit-taking, while $700M in liquidations showed leveraged positions being unwound, contributing to price swings within the overall positive month. [36, 51, 54, 140]

Corporate Bitcoin Accumulation: Ripple Labs' plan to raise $1 billion for XRP purchases and ongoing debate around corporate Bitcoin strategies (Saylor vs. Schiff) highlighted continued institutional interest in holding crypto as treasury assets, supporting longer-term bullish sentiment. [49, 66]

Blockchain & Distributed Ledger Technology +11.66%

Regulatory Relief and Political Support: Trump's pardon of Binance founder Changpeng Zhao removed a major regulatory overhang from the crypto industry's largest exchange, signalling a more favourable regulatory environment and boosting investor confidence across blockchain assets. [5, 17, 119]

Seasonal Strength and Technical Momentum: Bitcoin historically performs strongest in October, with the month living up to expectations as prices rose and technical indicators showed bullish patterns, creating positive momentum across the broader blockchain sector. [137, 159]

Institutional Adoption Acceleration: Major developments including Vanguard's potential entry into crypto ETFs, ten global banks exploring stablecoins, and NYSE owner's $2 billion investment in Polymarket demonstrated growing institutional acceptance of blockchain technology and digital assets. [89, 123, 134]

Whale Accumulation and Market Activity: Significant institutional buying activity, including $600 million in Ethereum purchases by whales and Ripple's plan to raise $1 billion for XRP purchases, indicated strong demand from sophisticated investors despite short-term volatility. [66, 159]

Real-World Blockchain Implementation: High-profile adoption cases like Bhutan's national identity system using Ethereum demonstrated practical utility of blockchain technology beyond speculation, supporting long-term value propositions. [85]

Quantum Technology +11.66%

Nobel Prize Validation: The 2025 Nobel Prize in Physics awarded to quantum computing pioneers (Clarke, Devoret, Martinis) provided significant scientific credibility and mainstream recognition to the quantum technology sector, validating decades of research and increasing investor confidence in the field's legitimacy. [26, 33, 82, 97, 101, 109, 143]

Major Technical Breakthroughs: Multiple announcements of quantum supremacy achievements, including Google's Quantum Echoes algorithm demonstrating 13,000x speed advantage over classical supercomputers and IonQ's record-breaking #AQ 64 benchmark achieved ahead of schedule, provided concrete evidence of accelerating technical progress and practical computational advantages. [6, 60, 88, 91, 149]

Institutional Capital Deployment: Significant institutional commitments including JPMorgan's $10 billion decade-long investment plan in quantum computing, PsiQuantum's $1 billion funding and Chicago facility groundbreaking, and potential Trump administration equity stakes in quantum firms signaled strong enterprise demand and government support, triggering immediate 20%+ stock price increases. [93, 105, 130, 133]

Commercial Traction and Real-World Applications: Demonstrations of practical applications including D-Wave's police optimisation project in Wales, Vanguard-IBM quantum-powered investing collaboration, and IonQ's strong revenue beat with path to profitability showed the technology moving beyond research into commercial deployment, validating investment theses. [104, 113, 129, 158]

Analyst Upgrades and Mainstream Coverage: Increased analyst coverage with Roth Capital raising D-Wave price targets, Zacks highlighting quantum stocks alongside tech giants (NVIDIA, Microsoft), and Benchmark analysts noting US "commanding lead" in quantum computing expanded mainstream investment community attention and positive sentiment.

Worst Performing Themes

Gambling -6.46%

Illegal Gambling Network Exposure: Discovery of malware-like browsers with dangerous hidden features linked to Asia's booming cybercrime and illegal gambling networks raised serious regulatory and reputational concerns for the gambling industry, potentially triggering investor risk aversion. [8, 99]

Fraud and Security Breaches: Multiple reports of gambling-related fraud, including a poker scheme that allegedly netted $7 million and broader scam operations stealing billions, highlighted vulnerabilities in gambling operations and likely increased regulatory scrutiny concerns. [8, 98]

Operational and Technical Issues: Technical glitches halting lottery draws and other operational problems suggested reliability concerns that could undermine consumer confidence in gambling platforms and services. [122]

Special Purpose Acquisition -4.83%

- Fraud and Governance Concerns: High-profile fraud case involving Aspiration fintech cofounder defrauding investors of $248 million reinforces negative sentiment around due diligence failures and fraud risks that have plagued the SPAC sector throughout 2024. Proxy firms rejecting major executive compensation packages also highlight ongoing governance issues.

Alternative Deal Structures Gaining Traction: Major transactions like EA's $55 billion sale to Saudi Arabia and private equity groups, plus companies like Aptera choosing to go public, demonstrate continued evolution in capital markets away from traditional SPACs toward other structures, potentially reducing SPAC relevance and deal flow. [112, 151]

IPO Market Dynamics: Discussions of IPO best practices and preparation strategies suggest traditional IPO routes may be becoming more attractive relative to SPAC mergers, potentially reducing SPAC appeal as companies have more viable alternatives for going public. [22, 115]

Cultural & Social Entertainment -4.72%

Concert/Live Event Disruptions: PlayStation's unexpected cancellation of most concert series dates and a fatal incident at a music festival signal operational challenges and safety concerns in the live entertainment sector, potentially dampening investor sentiment around live events revenue. [34, 144]

Streaming Platform Competition Intensifies: Taylor Swift's Eras Tour content moving to Disney Plus represents major content acquisitions that shift competitive dynamics, while Spotify adds venue tracking features, indicating platforms are fighting harder for user engagement in a saturated market. [12, 120]

Macroeconomic Headwinds on Consumer Spending: Amazon's plan to automate 600,000 jobs by 2033 raises concerns about reduced consumer purchasing power for discretionary entertainment spending, as automation could pressure wages and employment in the broader economy. [153]

Content Risk and Programming Challenges: Multiple TV shows being cancelled after single episodes and the challenging content environment reflected in various programming decisions suggest heightened risk aversion and difficulty in creating successful entertainment properties. [125]

Video & Audio Streaming -4.63%

Pricing Pressures and Subscriber Churn: Multiple streaming services raised prices by $2-3 per month, with Hulu Live TV seeing the biggest increase. This pricing action, combined with reported surges in Disney+ cancellations and evidence of "cord-reviving" as consumers return to cable, suggests subscriber fatigue with rising streaming costs drove negative sentiment. [48, 70, 74]

Regulatory Headwinds: California enacted new legislation forcing streaming platforms like Netflix, Hulu, and YouTube to regulate advertisement volumes, creating additional compliance costs and operational constraints for ad-supported streaming tiers that are increasingly important to profitability. [2, 68, 147]

Intensifying Competition and Fragmentation: The market showed signs of increased competitive pressure with new bundling strategies (Apple TV/Peacock), emerging low-cost micro-drama platforms challenging traditional streamers, and platforms diversifying into each other's territories (Netflix into podcasts, Spotify into video), indicating margin compression and market share battles. [76, 90, 160]

Subscription Model Profitability Concerns: Microsoft's reported $300 million loss from putting Call of Duty on Game Pass, combined with ESPN's subscriber retention challenges post-football season, highlighted fundamental questions about the sustainability and profitability of subscription-based streaming models. [154, 155]

E-Cigarettes -4.47%

Global Regulatory Crackdown and Enforcement: Multiple jurisdictions intensified enforcement actions against vaping products, including Singapore's harsh penalties for drug-laced vapes, Malaysia's decision to stop issuing vape shop licenses from January 1, and EU consideration of potential vape bans. This created significant regulatory uncertainty for the industry. [27, 56, 61, 69, 80, 118, 127, 145]

Taxation Threats in Major Markets: France formally proposed ending the tax-free era for e-liquids in its 2026 budget, with strong negative consumer reaction. This fiscal pressure, combined with calls for increased tobacco/vaping taxes in other markets like Malaysia, signalled rising costs for consumers and potential demand destruction. [107, 111, 126, 152]

Youth Usage and Public Health Concerns: WHO's alarming report that 15 million children aged 13-15 use e-cigarettes globally, representing part of 100+ million total users, intensified public health scrutiny. This data point likely increased pressure for stricter regulations and advertising restrictions worldwide. [27, 128, 157]

Negative Health Research: Emerging studies linking vaping to increased prediabetes risk added to growing health concerns beyond traditional nicotine addiction, potentially impacting consumer confidence and regulatory sentiment. [30]

Product Safety and Contamination Issues: Multiple cases of drug-laced vapes (particularly etomidate-contaminated products) in Singapore and Malaysia damaged industry reputation and justified stricter enforcement, creating negative sentiment around product safety. [69, 118, 128]

Cross-Month Comparison

Batteries & Energy Storage +19.00% Exceptional momentum with 17% gain in September followed by 19% in October, showing sustained strength in the energy transition theme.

Quantum Technology +11.66% Strong outperformance with 38% in September and maintained double-digit gains at 12% in October, suggesting genuine commercial traction beyond hype.

Data Centers & High-Performance Computing +15.01% Consistent top-tier performance with 21% in September and 15% in October, likely driven by AI infrastructure buildout demand.

Cryptocurrency & Digital Assets +12.59% Resilient performance with 19% in September and 13% in October, indicating renewed institutional interest despite volatile macro conditions.

Genomics & Gene Editing +10.59% Dramatic reversal from 5% in September to 11% in October, potentially signalling breakthrough announcements or regulatory progress.

Medical Testing & Diagnostics +7.80% Sharp turnaround from -0.6% in September to 8% in October, suggesting undervaluation correction or sector rotation into healthcare.

Luxury Fashion & Accessories +8.17% Accelerated from modest 3% in September to 8% in October, indicating resilient high-end consumer demand despite economic concerns.

Biochemicals & Biotech +7.06% Notable recovery from -0.2% in September to 7% in October, possibly reflecting pipeline developments or M&A activity.

Aluminum +7.60% Strengthened from 6% in September to 8% in October, outpacing other metals and suggesting specific supply-demand dynamics.

Dental Equipment +6.00% Remarkable reversal from -7% in September to 6% in October, one of the most dramatic turnarounds worth investigating.

Outdoor Recreation +5.45% Impressive swing from -3% in September to 5% in October, potentially indicating seasonal positioning or consumer behaviour shifts.

Gold -0.95% Significant divergence with 18% in September but -1% in October, reflecting changing inflation expectations or dollar strength.

Silver -2.06% Even more dramatic reversal with 21% in September collapsing to -2% in October, suggesting profit-taking after industrial demand speculation.

Defense Technology & Products -2.86% Concerning decline from 10% in September to -3% in October despite geopolitical tensions, possibly indicating valuation concerns.

Interesting Themes

Genomics & Gene Editing +10.59%

Major Clinical Validation of Gene Therapies: The 95% cure rate for ADA-SCID "bubble boy" disease using one-time gene therapy provided strong clinical evidence of gene therapy effectiveness, likely boosting investor confidence in the commercial viability of genomic treatments. [92]

Significant Commercial Deals and Partnerships: AstraZeneca's $555 million AI-powered gene-editing deal with Algen signalled strong pharmaceutical industry commitment to gene editing technologies, demonstrating robust commercial interest and potential revenue streams for the sector. [102]

Breakthrough Gene Editing Technologies: Multiple reports of enhanced gene editing capabilities, including bacterial retron-based methods that can correct multiple mutations simultaneously, indicated accelerating technological progress that could expand addressable markets for gene editing companies. [52, 117]

Expanding Therapeutic Applications: Discoveries spanning cancer treatment (nanoparticle vaccines, EZH2 targeting), cholesterol management (DNA-based PCSK9 therapy), and agricultural genomics (triple-yield wheat) demonstrated the broadening commercial applications of genomics beyond traditional disease treatment, potentially expanding total addressable markets. [38, 40, 100, 131]

Progress in Overcoming Technical Barriers: Reports indicating that fixing mitochondrial DNA is "about to get a lot easier" and advances in CRISPR technologies suggest the sector is moving past previous technical limitations, reducing execution risk for genomics companies. [46]

Medical Testing & Diagnostics +7.80%

Alzheimer's Blood Test Approvals: FDA approval of a second blood test for Alzheimer's diagnosis represents significant regulatory progress and market expansion for diagnostic testing companies, potentially driving investor optimism about the sector's growth prospects. [95, 121]

Innovations in Blood Testing Technology: Multiple developments in blood-based diagnostics including needle-free testing methods, liver disease prediction models, and MS detection through blood proteins demonstrate strong innovation pipeline and expanding applications for diagnostic testing. [9, 77, 108, 132]

Strategic Partnerships in Life Sciences: Bio-Techne's expanded partnership with Oxford Nanopore Technologies through 2032 signals long-term growth opportunities and strengthened competitive positioning in the diagnostics and life sciences tools market. [67]

AI Integration in Diagnostics: Advances in AI-powered diagnostic tools, including X-ray analysis for arthritis prediction and healthcare professionals adopting AI workflows, suggest technological transformation that could enhance diagnostic accuracy and efficiency. [16, 73]

Genetic and Preventive Testing Growth: Increased focus on genetic screening for Type 1 diabetes and other conditions, along with emphasis on early disease detection, indicates growing demand for preventive diagnostic services. [14, 57]

Cybersecurity Concerns: The SimonMed Imaging breach affecting 1.2M patients highlights operational risks in the diagnostics sector, potentially creating short-term headwinds but also emphasising need for security investments. [37]

Luxury Fashion & Accessories +8.17%

Strong LVMH Performance Exceeded Expectations: LVMH reported €18B in revenue and saw its stock price surge 13% unexpectedly, significantly boosting investor confidence in the luxury sector's resilience and providing positive momentum for the broader luxury fashion market. [55]

Successful Creative Leadership Transitions: Major luxury houses executed highly successful creative director debuts, particularly Matthieu Blazy's standing-ovation reception at Chanel and Louise Trotter at Bottega Veneta, signalling renewed creative energy and positive brand momentum that likely boosted investor sentiment. [24, 44, 65, 71, 150]

Strategic Leadership Changes at Heritage Houses: Key appointments including Grace Wales Bonner at Hermès menswear and leadership transitions at Fendi and other major houses indicated strategic renewal at established luxury brands, potentially driving optimism about future growth and innovation. [19, 23, 42, 72]

Mixed Signals from Luxury Automotive: While Aston Martin's 11% stock plunge due to tariff impacts created headwinds in luxury automotive, the broader luxury fashion and accessories sector appeared insulated from these challenges. [11]

Major Corporate Restructuring: Kering's €4B sale of its beauty division to L'Oreal represented significant portfolio optimisation by a major luxury conglomerate, potentially viewed positively as strategic focus on core luxury fashion businesses. [29]

Biochemicals & Biotech +7.06%

Major Therapeutic Breakthroughs in High-Value Disease Areas: Multiple significant advances in Alzheimer's treatment, Huntington's disease, cancer immunotherapy, and diabetes demonstrated concrete progress in addressing major unmet medical needs, boosting investor confidence in biotech's ability to deliver transformative treatments. [43, 47, 59, 62, 156, 161]

Strategic M&A and Partnership Activity: Large-scale deals like AstraZeneca's $555M AI partnership and Bio-Techne's expanded collaboration signalled strong corporate confidence and capital deployment in biotech innovation, particularly in AI-enabled drug discovery platforms. [67, 102]

Gene Editing and Advanced Therapy Progress: Breakthroughs in gene editing technology, xenotransplantation, and novel therapeutic approaches demonstrated the sector's technological advancement and expanded treatment possibilities, supporting premium valuations. [38, 83, 84, 87, 117]

Nobel Prize Validation: The 2025 Nobel Prize in Medicine recognising autoimmune disease research provided scientific validation for immunology-focused biotech approaches, potentially boosting related company valuations and research funding. [64]

Strong Startup Funding Environment: Significant funding rounds like Midi Health's $50M raise with $150M revenue run rate indicated healthy venture capital appetite for biotech companies, supporting sector-wide sentiment despite some companies like Novo Nordisk cutting programs. [20, 162]

Aluminum +7.60%

Trade Policy Tensions and Tariff Threats: Escalating US-Canada trade disputes with Trump threatening additional 10% tariffs on Canadian imports and halting trade negotiations likely created uncertainty and potential supply disruptions for aluminum markets, as Canada is a major aluminum producer and exporter to the US. [39, 53, 96, 135, 163, 164]

Electric Vehicle Industry Growth: Ferrari and other automakers advancing EV technology increased positive sentiment around aluminum demand, as electric vehicles require 50-100% more aluminum than traditional vehicles for lightweight battery housings, structural components, and overall weight reduction to extend range. [4, 41]

Broader Trade Protection Measures: The EU's decision to cut steel import quotas by nearly half and increase tariffs to 50% signalled a global trend toward trade protectionism that likely supported aluminum prices through reduced import competition and supply constraints in related metals markets. [39]

Commodities Equity Performance Dashboard

This dashboard provides performance analytics for global equities with exposure to commodities-related themes in Theia Insights Industry Classification (TIIC), grouped by Industry (level two).

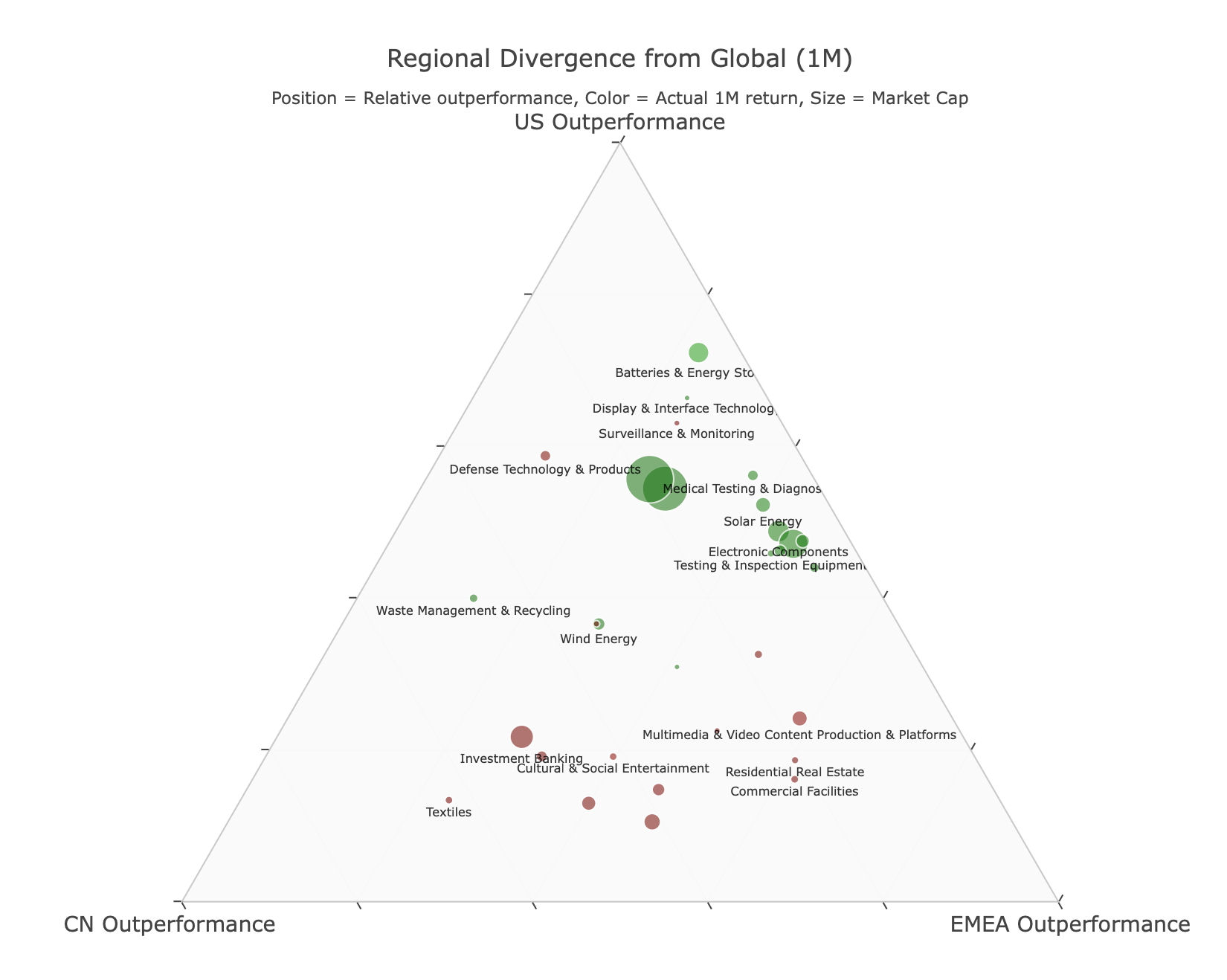

Regional Thematic Performance Overview (Top and Bottom Performing Themes by Region)

This analysis showcases the top three outperforming and underperforming investment themes across major regions, utilising the Theia Insights Industry Classification (TIIC) framework. By examining how identical themes perform differently across geographical markets, this breakdown illuminates the critical impact of regional economic dynamics, regulatory landscapes, and geopolitical developments on thematic investment returns.

Regional Performance Divergence vs Global

Each point's position indicates the relative regional outperformance compared to the global average. The analysis includes tradable portfolios in all three regions, eliminating themes that lack sufficient market presence or liquidity constraints.

Global Sector Thematic Performance (Top and Bottom Performing Themes by Sector)

This dashboard examines thematic investment performance organised by the top-level sectors within the Theia Insights Industry Classification (TIIC) framework. For each sector we report the top 3 and bottom 3 performing themes. By grouping themes under their primary sector classifications, this analysis reveals how broad sectoral trends influence underlying thematic opportunities and risks.

REFERENCES:

[1] Ferrari Reveals Its Electric Powerhouse, and What Could Finally Be Real EV Sound [2] California bans noisy ads on Netflix, YouTube, and other streaming services [3] The lab where GM is cooking up new EV batteries to beat China [4] Ferrari exposes the guts of its upcoming 1000hp EV [5] Trump pardons disgraced Binance founder Changpeng Zhao [6] Scientists Say We've Finally Reached Quantum Supremacy. For Real This Time! [7] US government takes equity stake in one of the world's largest lithium mines [8] The mysterious owner of a 'scam empire' accused of stealing $14bn in crypto [9] 6 Blood Tests That Can Tell You How Your Body Is Functioning [10] Roth Capital Raises the PT on D-Wave Quantum (QBTS), Maintains a Buy [11] Aston Martin warns investors that tariff pain won't go away anytime soon [12] Taylor Swift's Eras Tour Series and Final Show Film Coming to Disney Plus - Everything You Need to Know [13] Apple Starts Shipping Made-in-America AI Servers Early [14] Olivia Munn had a clear mammogram and no symptoms of breast cancer. A 2-minute online test led to her diagnosis at 43. [15] Polymarket Founder Is Youngest Self-Made Billionaire After Deal With NYSE Owner [16] This is your doctor on ChatGPT [17] Trump Pardons Binance Founder Changpeng Zhao [18] The New Chevy Bolt Is a Truly Affordable Electric Vehicle, Starting at Under $30,000 [19] Véronique Nichanian, directrice artistique pour l'homme à Hermès, quitte la maison de luxe après trente-sept ans [20] Novo Nordisk halts work on cell therapy for diabetes to cut costs, Bloomberg News reports [21] Morgan Stanley says the colossal AI spending spree could pay for itself by 2028 [22] Experts share strategies for a successful IPO [23] Hermès nomme Grace Wales Bonner directrice de création des collections masculines [24] Matthieu Blazy, le nouveau visage de Chanel - « Ce n'est pas parce que Karl était un monument que la personne qui dessine les collections doit forcément en être un » [25] 'Circular AI Mega-Deals' by AI and Hardware Giants are Raising Eyebrows [26] Nobel Prize in Physics Awarded to John Clarke, Michel Devoret and John Martinis [27] Alarming number of people now vape, says WHO [28] Amazon, Meta, Microsoft, and Google are gambling $320 billion on AI Infrastructure. The payoff isn't there yet. [29] Kering sells beauty division to L'Oreal and says the companies will collaborate on wellness products [30] Vapoter entraînerait un risque accru de développer un prédiabète selon une étude de grande ampleur [31] Oracle and OpenAI's second Stargate data center in Texas will be powered off the grid [32] Tesla reveals its long-awaited affordable models, the $36,990 Model 3 Standard and $39,990 Model Y Standard. [33] 2025 Nobel Prize in Physics Goes to Researchers Who Brought Quantum Mechanics into the Macroscale World [34] Woman injured from debris while leaving Salt Lake music festival has died, family says [35] How anonymous is bitcoin? US seizure of tycoon's US$13 billion in tokens raises questions [36] Trump Insider Whale Holds $340 Million in Short Position on Bitcoin [37] Hackers steal medical records and financial data from 1.2M patients in massive healthcare breach [38] New treatment cuts cholesterol by nearly 50%, without statins or side effects [39] EU to cut steel import quotas, hike tariffs to 50% [40] This "chaos enzyme" may hold the key to stopping cancer spread [41] Ferrari goes electric with four-seat coupe but shares get shocked [42] Silvia Venturini Fendi Steps Down as Creative Director of Fendi [43] New nanotherapy clears amyloid-β reversing Alzheimer's in mice [44] Louise Trotter's Debut Bottega Veneta SS26 Collection Breathes New Air Into the Heritage House [45] Feds seize $15 billion in crypto from 'pig butchering' scheme involving forced labor camps [46] Faulty mitochondria cause deadly diseases - fixing them is about to get a lot easier [47] The Hunt for Huntington's [48] New Pricing for Disney Plus, Hulu and ESPN Is Here, What You Need to Know [49] Peter Schiff Challenges Michael Saylor's BTC Strategy [50] Gold steadies, bitcoin plunges as debasement trade rally comes to a halt [51] $100 Million Lost in One Hour - Bitcoin Drops Spark Rampaging Liquidations [52] A miniature CRISPR–Cas10 enzyme confers immunity by inhibitory signalling [53] Trump tariffs live updates - White House nears tariff relief for auto industry; US deficit falls in first drop since COVID [54] Bitcoin Whales Lose Patience as Average Dormancy Hits Monthly High in October [55] Umsatz von 18 Milliarden Euro - Anleger greifen nach Luxus – LVMH-Aktienkurs steigt überraschend um 13 Prozent [56] EU could ban filtered cigarettes – Bild [57] Can Genetic Testing Predict Type 1 Diabetes? Experts Say Earlier Treatment Is Possible [58] OpenAI's new chip deals raise a tough question - Where will all the power come from? [59] A Cure for Type 1 Diabetes May be Closer Than You Think [60] Google claims quantum advantage again but researchers are sceptical [61] Three shops closed over illegal vapes and tobacco [62] First Treatment that Slows Huntington's Disease Comes after Years of Heartbreak [63] How Talen Energy's AI-Focused Battery Storage Partnership With Eos Could Shape TLN's Investment Story [64] 2025 Nobel Prize in Physiology or Medicine Awarded for Discoveries Key to Treating Autoimmune Disease [65] Fashion Week in Paris - Matthieu Blazy feiert sein Chanel-Debüt [66] Ripple Labs to Raise $1 Billion for XRP Purchases-A Bullish Move or Weary Indicator? [67] Bio-Techne (TECH) - Valuation Spotlight Following Expanded Oxford Nanopore Partnership and Growth Strategy Realignment [68] California Law Forces Netflix, Hulu To Turn Down Ad Volumes [69] 18-year-old charged for alleged trafficking of suspected etomidate vape pods [70] Cable Nostalgia Persists As Streaming Gets More Expensive, Fragmented [71] The World Really Does Revolve Around Chanel [72] Wales Bonner Always Knew She Was Destined to "Disrupt" Hermès [73] AI turns x-rays into time machines for arthritis care [74] Disney+ cancellations surged as boycotts for Jimmy Kimmel's suspension kicked in-here's how big the spike was [75] While OpenAI races to build AI data centers, Nadella reminds us that Microsoft already has them [76] Soapy, low-cost micro dramas are exploding in the US, challenging Hollywood streamers like Peacock and HBO [77] Simple blood test predicts liver disease years before symptoms [78] EEUU ha decomisado 15.000 millones de dólares en bitcoin. Así funciona la terrorifica criptoestafa de la "matanza de cerdos" [79] How China Took Over the World's Clean Energy Boom [80] Perak Health Dept to monitor vape shops after decision to stop renewing licences from Jan 1 [81] OpenAI signs multi-billion dollar chip deal with AMD [82] Nobel Prize for Physics awarded to trio for quantum mechanics discoveries [83] Un paciente chino prolonga su vida casi seis meses tras el trasplante de un hígado de cerdo genéticamente modificado [84] This type of meat supercharges muscle growth after workouts [85] Un país ha emprendido el mayor experimento con criptomonedas del mundo - Bután y los 800.000 carnés de identidad con Ethereum [86] Can "second life" EV batteries work as grid-scale energy storage? [87] Breakthrough cancer therapy stops tumor growth without harming healthy cells [88] Google's latest quantum breakthrough is 13,000 times faster than before [89] Hace cinco años trabajaba desde su baño al borde de la ruina. Hoy dirige una empresa valorada en 8.000 millones [90] Spotify quiere vídeo, Netflix quiere podcasts - vamos a ver muchas cosas extrañas mientras las plataformas luchan por sobrevivir [91] Google logra la primera ventaja cuántica verificable - su chip Willow supera a los superordenadores 13.000 veces [92] 95% of kids with "bubble boy" disease cured by one-time gene therapy [93] Trump administration in talks to take stakes in quantum-computing firms - Report [94] Deutschlands größter Batteriespeicher entsteht in Sachsen-Anhalt [95] Daily briefing - Time to retire the Turing test? [96] Canada will not allow unfair US access to markets if trade talks fail, says Carney [97] Nobel Prize in Physics awarded to 3 scientists for quantum mechanical tunnelling [98] X-ray tables, high-tech glasses, NBA players - How a poker scheme allegedly stole millions [99] This 'Privacy Browser' Has Dangerous Hidden Features [100] Mutant wheat breakthrough could triple grain yields [101] Nobel Prize in Physics goes to early research that led to today's quantum computers [102] AstraZeneca Signs Up For $555 Million AI Deal With Algen To Develop Therapies [103] OpenAI partners with Broadcom to produce its own AI chips [104] 2 top execs at Vanguard lay out their vision for quantum-powered investing [105] PsiQuantum breaks ground on Chicago quantum site after $1 billion funding [106] The 2027 Chevy Bolt will be one of the cheapest EVs you can get [107] Budget 2026 - les députés s'écharpent sur la taxation de la vape [108] Needle-phobes, rejoice — you can now draw blood without a poke [109] Nobel physics prize goes to pioneers of quantum mechanics [110] AI Is the 'Biggest Driver' of Electricity Use in North America, a New Energy Report Shows [111] Taxe sur le vapotage au budget 2026 - Pour les consommateurs, c'est « un non-sens », « mesquin », « aberrant »… [112] Three-Wheeled Solar Car Maker Aptera is About to Go Public [113] Why D-Wave Quantum (QBTS) Is Up 38.4% After Quantum Tech Cuts Police Response Times in Wales [114] Cofounder of fintech once backed by Steve Ballmer and Drake pleads guilty to wire fraud [115] Dealmaking is heating up again. Goldman Sachs breaks down what founders should do after they cash out. [116] Nvidia backs $6 billion battery recycling giant in bid to power the AI boom [117] Scientists just made gene editing far more powerful [118] 102 caught with drug-laced vapes, 67 placed on rehab programmes since start of harsher penalties [119] Trump pardons billionaire Binance founder Changpeng Zhao [120] New Spotify Feature Lets Music Lovers Track Concerts At Their Favorite Venues [121] Blood tests are now approved for Alzheimer's - how accurate are they? [122] Lotto jackpot draw halted by technical glitch [123] Diez gigantes de la banca se lanzan a por las 'stablecoins'. Están intentando no perder el tren del dinero digital [124] North Carolina's largest data center is going up in west Charlotte despite other proposals getting more fanfare [125] 10 TV Shows That Were Canceled After A Single Episode [126] 'Time to raise tax on cigarettes' [127] Johor seizes 450 vape and e-cig products in statewide operation, says Ling [128] 'For her own good' - Why this father reported his teen daughter for using drug-laced vapes [129] Stocks to Gain From Quantum Computing in 2025 - MSFT, IBM, QBTS, IONQ [130] JPMorgan Chase launches a decade-long plan to invest $10B in industries critical for national security, including "frontier tech like AI and quantum computing [131] This experimental "super vaccine" stopped cancer cold in the lab [132] Scientists detect hidden brain damage years before MS symptoms [133] Quantum computing stocks jumped after JPMorgan announced a $10B strategic tech investment; Arqit, D-Wave, Rigetti, and IonQ each rose about 20% [134] Vanguard U-Turn on Crypto ETFs Could Be Explosive for Bitcoin [135] Cold shoulder from Canada is costly for American distillers struggling with global trade tensions [136] NVDA vs. AMD - Which AI Hardware Stock Has Better Investment Potential? [137] Bitcoin has more room to run in October - A closer look [138] US has a 'commanding lead' in quantum computing-for now [139] OpenAI is eying a $25 billion data center project in Argentina. [140] This Crypto Trader Made $160 Million Profit During Trump's Market Bloodbath [141] The Zacks Analyst Blog Highlights NVIDIA, Microsoft, IBM, D-Wave and IonQ [142] Data centers in one nation are driving power demand like nowhere else [143] This Year's Nobel Physics Prize Showed Quantum Mechanics Is a Big Deal-Literally [144] PlayStation Cancels Most Of Its Concert Series Without Explanation [145] Over 9,200 vape pods found in cargo container, 25-year-old man arrested [146] A second major proxy firm told investors to reject Elon Musk's $1 trillion Tesla pay deal [147] New California Law Tells Loud Ads on Streaming Services to Pipe Down [148] Virginia's data center construction boom is even bigger than you think. One company is behind most of it [149] This Quantum Computing Stock Just Set Another Scientific Record. Should You Buy It Here? [150] Paris Fashion Week Debuts From Chanel, Loewe, Balenciaga & More In This Week's Top Fashion News [151] EA Announces Unprecedented $55 Billion Sale To Saudi Arabia, Jared Kushner's Private Equity Group, And Others [152] Taxe sur le vapotage - le portefeuille des vapoteurs va trinquer! [153] Amazon's master plan to replace 600,000 workers with robots by 2033 — complete with a "good corporate citizen" play to avoid backlash from the growing divide between the tech elite and normal people [154] ESPN's new app is exceeding expectations so far — but its biggest challenge is still ahead [155] Report - Call Of Duty - Black Ops 6 On Game Pass Cost Microsoft $300 Million In Lost Sales [156] MIT's "stealth" immune cells could change cancer treatment forever [157] OMS alerta - 15 milhões de jovens de 13 a 15 anos usam cigarros eletrônicos [158] Here's How IonQ is Paving its Profitability Path in the Quantum Race [159] Ethereum Price Flashes 3 Bullish Signals as Whales Scoop Up $600 Million in ETH [160] The Apple TV and Peacock Bundle Is Here [161] New Alzheimer's Treatment Clears Plaques From Brains of Mice Within Hours [162] Midi Health raises $50 million in funding as the menopause startup bets on longevity and AI [163] Trump's halt of US-Canada trade talks could impact these prices [164] Trump threatens Canada with 10% extra import tax for not pulling down anti-tariffs ad soonerGet In Contact

press@theiainsights.comAbout Theia Insights

Theia Insights is a deep tech company based in Cambridge (UK), building foundational AI for the global investment community. We are a team of PhD scientists, engineers, mathematicians, and industry practitioners offering clients future-proof solutions in Industry Classification, Thematic Risk Models, and Portfolio Analytics. Named after the goddess of sight, Theia synthesises and distils vast amounts of financial information so investors can see more clearly. To learn more, visit www.theiainsights.com.