November 2025 Performance Synopsis

The performance dispersion of over 37 percentage points between the best and worst performers underscores the month's dramatic sector rotation, with investors clearly favouring established healthcare franchises and tangible assets over speculative growth and technology.

Best Performing Themes

Weight Loss & Diabetes +13.25%

GLP-1 Drug Development and Clinical Trial Results: Novo Nordisk's disappointing Alzheimer's trial results for semaglutide tempered expansion hopes, while positive findings linking GLP-1s to improved cancer survival opened new market opportunities. These mixed clinical developments created volatility but ultimately supported the sector's growth trajectory. [51, 91, 95]

Competitive Dynamics and Market Expansion: Pfizer's lawsuit against Novo Nordisk and Metsera highlighted intensifying competition in the lucrative obesity/diabetes drug market, while Novo's continued pursuit of opportunities and Omada Health's expansion into GLP-1 prescriptions demonstrated robust market growth and new distribution channels. [9, 45, 80]

Policy and Pricing Pressures: Immigration policies targeting obesity/diabetes and political opposition to drug pricing agreements with major manufacturers (Eli Lilly, Novo Nordisk) created regulatory uncertainty, though the 13.25% return suggests investors remained optimistic about the sector's fundamental growth prospects despite these headwinds. [1, 90]

Growing Disease Burden: Multiple studies linking ultra-processed foods, sugar consumption, and modern lifestyles to rising obesity and diabetes rates reinforced the expanding patient population and long-term market opportunity for weight loss and diabetes treatments. [10, 13, 15]

Silver +12.46%

Strong Institutional and Central Bank Demand: Governments and central banks significantly increased precious metals purchases, with one source noting they are "buying it all," creating supply constraints and driving prices higher. [32, 81]

Safe-Haven Investment Flows: As cryptocurrency markets experienced volatility (Bitcoin falling from $126,000 to $95,000), investors sought refuge in traditional precious metals like silver, with prominent investors like Robert Kiyosaki actively promoting silver purchases as wealth protection. [78, 79, 92]

Supply-Demand Imbalance in Industrial Markets: Gold prices soaring over 50% created ripple effects across the jewellery and industrial sectors, with companies forced to adapt to volatile precious metals costs, indicating sustained demand pressure across multiple sectors. [32, 33]

Gold +11.87%

Strong Year-to-Date Performance and Recent Volatility: Gold rallied over 50% in 2024, hitting record highs in October before retracing some gains, with November's 11.87% return representing continued strong momentum despite recent pullbacks from peaks. [37, 97]

Central Bank and Government Buying: Governments and central banks have been aggressive buyers of gold, with specific examples including China's gold storage initiatives and Cambodia storing reserves in Shanghai Gold Exchange vaults, driving sustained demand. [81, 93]

Jewellery Industry Impact and Cost Pressures: Soaring gold prices created significant challenges for jewellers who faced volatile costs and cautious customers, with companies like Mejuri introducing alternative metals to cope with price pressures, indicating tight supply-demand dynamics. [33, 37]

Retail Investor Behaviour Shift: Retail investors showed cooling interest in gold during volatile market conditions, suggesting institutional and central bank buying may have been more significant drivers than retail demand. [29]

Professional Outlook Remains Positive: Major financial institutions like Goldman Sachs maintained bullish forecasts for gold into 2026, supporting continued investor confidence despite short-term price fluctuations.

Medical Treatment Products +10.25%

Positive Healthcare Technology Innovation: Multiple breakthrough medical devices received FDA approval or demonstrated advancement, including speech-restoring brain chips, wireless brain implants, smart health-tracking wearables, and diabetes monitoring devices. These innovations signal strong R&D momentum in the medical treatment products sector. [82, 83, 84, 52]

AI Integration in Healthcare: Big Pharma's rapid AI integration lifted healthcare ETFs, while OpenAI's potential entry into consumer health apps indicates transformative technology adoption that could enhance medical product development and delivery efficiency. [7, 28]

Medicare and Insurance Cost Pressures Creating Mixed Demand Dynamics: Rising Medicare premiums and soaring ACA costs created affordability challenges that may constrain some medical product demand, but also increased focus on cost-effective treatments and biosimilar approvals, potentially benefiting certain product segments. [19, 20, 27, 72]

Aesthetic and Specialty Treatment Innovation: Novel aesthetic medical treatments like polynucleotides from fish sperm demonstrate expanding market opportunities in elective medical procedures, representing high-margin growth areas for medical treatment product companies. [2, 5, 39]

Regulatory Progress and IP Value: FDA approvals for advanced medical devices and significant patent litigation outcomes like the $634M Apple Watch verdict underscore both the regulatory pathway opportunities and intellectual property value in medical technology, supporting sector valuations. [4, 82]

Pharmacology +9.83%

GLP-1 Obesity Drug Market Expansion: Multiple deals between pharmaceutical companies (Novo Nordisk, Eli Lilly) and the White House expanded Medicare coverage and lowered prices for weight-loss drugs like Ozempic and Wegovy to $50-$149 copays, significantly broadening market access despite pricing pressure. The volume expansion likely offset price reductions, driving positive sentiment. [8, 11, 21, 44, 50, 98]

Intense M&A Activity in Obesity Drug Space: Pfizer's $10 billion acquisition of Metsera (double the original bid) after a bidding war with Novo Nordisk demonstrated extremely high valuations and strong competitive dynamics in the obesity drug development market, signalling robust investor confidence in this therapeutic area. [38, 85]

Breakthrough Diagnostic and Treatment Innovations: Major advances including blood tests for Alzheimer's enabling earlier treatment with monoclonal antibodies, AI-driven antibiotic development for superbugs after a 50-year lull, and promising new cancer pills represented significant pipeline value creation for pharmaceutical companies. [3, 6, 46, 47]

Medicare Drug Price Negotiations Impact: While Medicare negotiated significant price cuts (71% on some drugs), the simultaneous expansion of coverage and market access, particularly for high-demand medications, likely resulted in net positive volume effects that supported sector performance. [8, 52]

AI Integration Across Pharma: Big Pharma's rapid integration of artificial intelligence for drug discovery and development represented operational improvements and pipeline acceleration that enhanced long-term growth prospects for the sector. [41]

Worst Performing Themes

Quantum Technology -24.35%

Earnings Disappointments and Financial Warnings: Multiple quantum computing companies reported revenue misses and issued significant financial warnings, with Rigetti's Q3 miss and the collective $749 million warning from pure-play quantum stocks signalling fundamental business challenges and lack of near-term profitability. [14]

Extreme Valuation Concerns and Speculative Bubble: Quantum stocks like Rigetti and D-Wave surged over 1,900% in the past year before correcting, indicating unsustainable valuations driven by speculation rather than fundamentals, leading to sharp November corrections. [66]

Extended Commercialisation Timeline: Industry announcements pushing practical quantum computing milestones to early 2030s (IBM/Cisco networks, weaponised quantum by 2029) suggest revenue generation remains distant, undermining current valuations based on near-term expectations. [12, 87]

Technical Challenges Persist: Despite breakthroughs like millisecond-coherence qubits, the sector continues facing fundamental obstacles to practical quantum computing, with experts emphasising quantum computers still need classical computing integration to be useful. [36, 70]

Competitive Pressure and Market Saturation: New entrants like Xanadu going public at $3.6B valuation and established players like IBM advancing chip technology intensify competition, potentially compressing margins and market share for existing pure-play quantum stocks. [67, 86]

Law Enforcement -16.19%

Regulatory Violations and Legal Challenges: DHS violated domestic espionage rules by retaining Chicago police records for months, creating legal liability concerns for law enforcement agencies and their technology vendors. Court ruling blocking National Guard deployment to Portland further constrained federal law enforcement authority. [17, 91]

Privacy and Surveillance Concerns: Growing implementation of surveillance technology in schools and public spaces raised privacy concerns that could lead to regulatory backlash, potentially limiting market opportunities for law enforcement technology providers. [18]

Operational and Authority Constraints: Multiple legal challenges and court rulings limiting law enforcement deployment and authority created uncertainty about the scope and scale of future law enforcement operations, potentially impacting revenue projections for companies serving this sector. [88, 89]

Cryptocurrency & Digital Assets -15.39%

Bitcoin Price Collapse: Bitcoin fell below $93,714 in November, erasing its entire year-to-date gains of over 30% from an all-time high reached just a month earlier, representing a significant bear market deepening. [53]

Regulatory Crackdown and Fraud Concerns: Increased DOJ enforcement actions against crypto scam operations, seizure warrants related to fraud compounds, and high-profile crypto heist cases created negative sentiment around security and regulatory risks in the cryptocurrency space. [23, 24]

Retail Investor Retreat: Retail traders showed cooling interest in bitcoin during the volatile period, with reduced buying activity during price dips, indicating weakening demand from a key market segment. [29, 55]

Mixed Institutional Signals: While Harvard made a significant $443 million investment in Bitcoin through BlackRock's iShares Bitcoin Trust, central banks globally expressed wariness toward digital assets, creating conflicting signals about institutional adoption. [54, 56]

Regulatory Uncertainty from Trump Administration: Trump's pardon of Binance founder CZ created uncertainty about future crypto regulation and enforcement, with potential unintended consequences for the US crypto industry that may have contributed to market volatility. [22]

Blockchain & Distributed Ledger Technology -13.42%

Severe Price Decline and Bear Market: Bitcoin erased all 2025 gains, falling from $126,000 peak to below $87,000-$93,000, representing a 30%+ decline that wiped out trillions in market cap and triggered extreme fear sentiment. [49]

Massive Liquidations and Whale Selling: The market experienced $1.38-$1.9 billion in liquidations with major holders including billionaires and early Bitcoin adopters dumping positions worth billions, creating cascading selling pressure and capitulation signals. [48, 63, 64, 65, 77]

Institutional and Retail Confidence Erosion: Retail investors cooled on Bitcoin while crypto companies filed for bankruptcy and shut down operations, signalling deteriorating fundamentals and business viability during the downturn. [29, 42, 49, 73]

Political and Regulatory Uncertainty: Connection between Bitcoin's decline and "unraveling of Trump trade," combined with controversial pardons of crypto figures like CZ, created regulatory uncertainty that undermined investor confidence. [22, 61, 69]

Security Concerns and Fraud Legacy: High-profile Bitcoin heists, sophisticated scams, and ongoing FTX trial developments reminded investors of sector vulnerabilities and past frauds, maintaining negative sentiment throughout the month. [23, 31]

Aerospace & Science Satellites -12.43%

Launch Failures and Operational Setbacks: Multiple rocket failures, including Galactic Energy's Ceres-1 losing 3 satellites and Rocket Lab delaying Neutron to 2026, undermined investor confidence in commercial satellite launch reliability and near-term growth prospects. [34, 60, 62, 68]

Space Debris and Safety Concerns: High-profile incidents including debris strikes on Chinese spacecraft requiring rescue missions and research revealing widespread space junk risks significantly increased perceived operational hazards and potential insurance/compliance costs for satellite operators. [43, 58, 71, 75]

Intensifying Competition in Satellite Communications: Amazon's aggressive push into satellite internet with Leo (150+ satellites launched) and Starlink's market expansion created concerns about market saturation, pricing pressure, and competitive dynamics in the satellite communications sector. [25, 26, 30, 35]

Security and Regulatory Headwinds: Discovery of "shockingly large" unencrypted satellite communications vulnerabilities and potential EU restrictions on Chinese participation in research programs raised concerns about regulatory crackdowns, security requirements, and international collaboration constraints affecting the sector. [57, 59, 74]

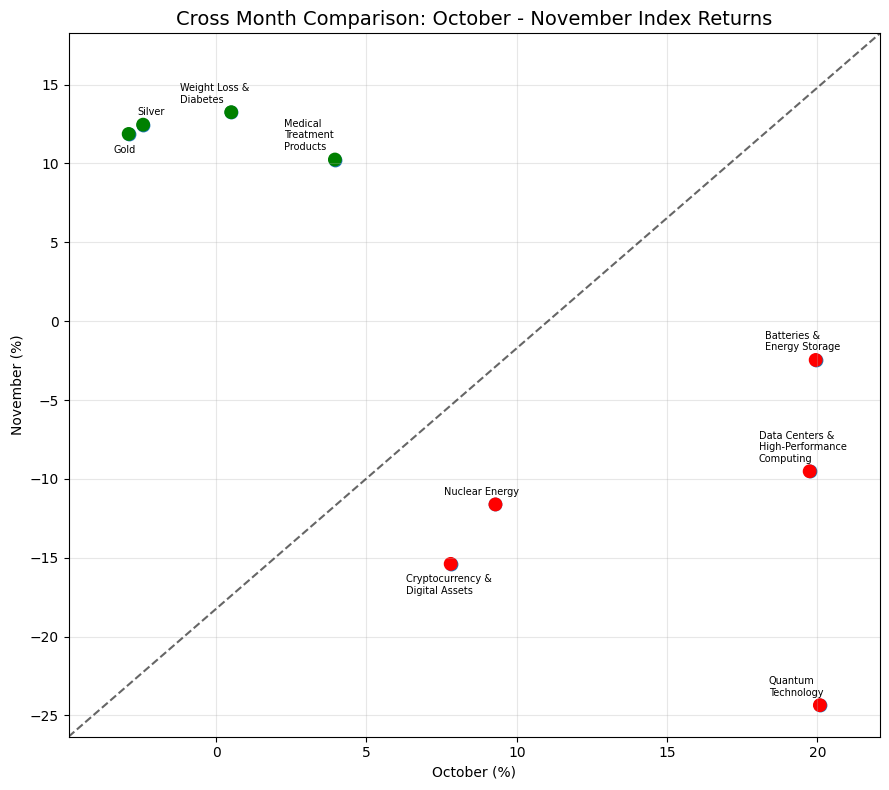

Cross-Month Comparison

In November, the strongest performer from the previous month - Quantum Technology, fell sharply into negative territory. Another October leader, Cryptocurrency & Digital Assets, also saw its fortunes fully reverse. Its related theme, Blockchain & Distributed Ledger Technology, experienced a similar downturn, pointing to a broad-based decline across crypto-related areas.

Interesting Themes from Cross-Month Comparison

Batteries & Energy Storage Oct +9.94% → Nov -2.46%

Intensifying Price Competition and Margin Pressure: Multiple companies offering "zero-margin" pricing and aggressive discounts on power stations and battery products indicate severe competitive pressure and potential oversupply in the energy storage market, compressing profitability across the sector. [76, 99, 103, 104, 105, 106, 107, 108, 109, 110, 111]

EV Market Headwinds and Demand Concerns: Major automakers reporting significant losses ($1.4B for Ford), struggling sales (Cybertruck), infrastructure challenges (GM charging issues), and strategic reversals signal weakening EV adoption momentum, which directly reduces battery demand and creates uncertainty about growth projections. [81, 102, 113, 118]

Technology Disruption and Competitive Threats: Announcements of breakthrough battery technologies (Toyota's 40-year batteries, QuantumScape's solid-state revolution, LFP patent expiry) create uncertainty about the value of current battery technology investments and suggest potential obsolescence of existing products. [112, 115]

Supply Chain and Geopolitical Risks: GM's directive to remove Chinese components from supply chains, combined with aggressive Chinese competition (BYD expansion), creates uncertainty about supply chain stability, costs, and competitive dynamics in the global battery market. [101, 114, 116]

Corporate Distress and Business Model Concerns: Bankruptcy filings in renewable energy, startup shutdowns (Monarch Tractor), and significant stock drops (Bloom Energy -19.6%) indicate broader financial stress in the energy storage ecosystem and raise questions about business model viability. [100, 117, 119]

Data Centers & High-Performance Computing Oct +19.74% → Nov -9.52%

Bubble Concerns and Overinvestment Fears: Multiple reports indicated growing investor anxiety about unsustainable AI infrastructure spending, with fund managers surveyed showing 20% net believing companies are overinvesting in AI. Warnings from prominent investors like Mark Cuban about an AI bubble similar to the search engine crash, combined with questions about $350B+ in capex sustainability, likely drove negative sentiment and the -9.52% November decline. [123, 126, 129, 130, 136]

Infrastructure Constraints and Execution Challenges: Critical bottlenecks emerged including power shortages (data centres standing empty awaiting electricity in Nvidia's hometown), water consumption bans (Malaysia blocking low-tier data centres), and capacity crunches (Amazon's AI capacity issues pushing customers to rivals). These operational challenges signalled that aggressive expansion plans may face significant delays and cost overruns. [128, 132, 133, 138]

Rising Costs and Supply Chain Pressures: RAM prices surged to unprecedented levels, memory chip prices increased due to AI data centre demand, and component shortages forced companies like Lenovo to stockpile 50% higher inventories. These cost inflation pressures threatened profit margins and made the economics of data centre operations less attractive. [125, 139]

Regulatory and Community Opposition: Local resistance to data centres skyrocketed, EPA scrutiny of data centre chemicals intensified, and concerns about electricity demand creating blackout risks emerged. Growing regulatory headwinds and community pushback indicated potential obstacles to planned expansions and increased compliance costs. [122, 124, 127, 135, 137]

Demand Sustainability Questions: While consumer AI adoption showed strength, Goldman Sachs analysts noted AI was "way behind with businesses," raising questions about enterprise demand sustainability. Concerns that Google must double capacity every 6 months suggested an unsustainable growth trajectory that could lead to overcapacity. [131, 134]

Nuclear Energy Oct +9.29% → Nov -11.62%

Sharp Stock Decline Despite Investment Pledges: Nuclear and uranium stocks plunged 15-45% in November despite major investment announcements like the US-Canada $80 billion reactor partnership, indicating market skepticism about near-term profitability and long timelines to commercial operation. [142, 143]

High Development Costs and Regulatory Complexity: UK identified as world's most expensive place to develop nuclear power due to "overly complex" regulations, with US criticism of UK nuclear approach, creating concerns about project economics and regulatory barriers across Western markets. [140, 141]

Geopolitical and Operational Risks: Europe's largest nuclear plant operating on emergency diesel generators for extended period and ongoing concerns about nuclear facilities in conflict zones highlighted operational vulnerabilities and geopolitical risks affecting sector stability. [144]

Delayed Timeline for Returns: Market recognition that nuclear energy payoffs remain "years away" despite AI-driven energy demand, causing investors to reassess valuations and take profits after October gains, particularly as regulatory approvals and construction timelines extend. [142, 143]

Region Best/Worst Performing Themes

Gambling: EMEA -8.30% vs US -5.60%

Industry Consolidation and Platform Shutdowns: ESPN Bet's closure and transition to DraftKings partnership suggests market consolidation pressures and potential struggles for smaller or newer gambling platforms to compete profitably, which could have dampened overall sector performance. [145]

Integrity Scandals Damaging Consumer Confidence: The indictment of MLB pitchers for rigging online bets represents a significant blow to the legitimacy and trustworthiness of sports betting markets, potentially reducing consumer engagement and betting volumes across platforms. [146]

Competitive Pressures in Sports Betting Market: The ESPN-DraftKings partnership indicates that even major media brands struggled to maintain independent betting platforms, suggesting intense competitive dynamics and margin pressures that may have affected profitability across the gambling sector in both EMEA and US markets. [145]

Telecommunications Satellites: US +18.84%

Amazon's Aggressive Market Entry: Amazon rebranded Project Kuiper to Amazon Leo and launched enterprise testing, securing 80+ launch contracts (the largest commercial procurement in history) and positioning itself as a major Starlink competitor. This signalled significant new competition and market expansion in satellite communications. [26, 147, 149, 151, 152, 161, 166]

Strong Financial Performance from Key Players: Viasat exceeded Q2 earnings estimates and Globalstar reported upbeat Q3 results with revenue growth, demonstrating solid operational performance in the telecommunications satellite sector that likely boosted investor confidence. [153, 154]

Major M&A and Spectrum Acquisitions: SpaceX's $2.6 billion acquisition of AWS-3 spectrum licenses from EchoStar for direct-to-cell services represented significant market consolidation and expansion of satellite-to-mobile capabilities, validating the sector's growth trajectory. [155, 160]

Direct-to-Device Technology Advancement: The emergence of direct-to-device (D2D) satellite communications as a cornerstone technology, with T-Mobile expanding free satellite-based 911 texting and Apple preparing additional iPhone satellite features, demonstrated accelerating consumer adoption and mainstream integration. [150, 156, 165]

Government and Institutional Support: Europe's €2.1 billion funding package for secure satellite communications and multiple defence contracts (BlackSky's $30M+ contract, various national space programs) showed strong institutional backing and diversified revenue streams beyond commercial applications. [157, 158, 159]

Geographic Market Expansion: OneWeb and other operators targeting Asia-Pacific as a key growth engine, along with Taiwan's satellite constellation launches, indicated global market expansion beyond traditional Western markets. [162, 163, 164]

Coal CN +14.93%

Weakening Global Climate Action and Policy Retreat: Multiple UN climate summits (COP30) failed to secure meaningful fossil fuel commitments, with final agreements not even mentioning fossil fuels. Major economies like Canada rolled back climate rules, and Britain eased opposition to new fossil fuel permits, creating a more favourable regulatory environment for coal.

Major Shift in Energy Demand Forecasts: The International Energy Agency dramatically revised its outlook, now predicting oil and gas demand will continue rising through mid-century rather than peaking soon. This represents a significant tonal shift suggesting fossil fuels, including coal, have a longer runway than previously expected. [169, 171]

Continued Emissions Growth Despite Climate Goals: Global fossil fuel emissions hit new record highs in 2025, with total emissions from fossil fuels expected to reach another peak. While China's emissions appear to be levelling off, overall global demand remained strong, supporting coal prices. [167, 172]

Strategic Energy Security Concerns: Countries prioritised energy security over climate commitments, with coal maintaining its position as a critical energy source. The recognition of coal access as a factor in military power and the emergence of new fossil fuel frontiers indicated sustained strategic importance of coal resources. [168, 170]

E-Cigarettes APAC-ex-CN -9.65%

Aggressive APAC Regulatory Crackdown: Multiple jurisdictions in APAC implemented or proposed severe restrictions, including Maldives' unprecedented generational ban (first globally), Russia's potential total vape ban with "liquid poison" rhetoric, and Australia's federal crackdown with significant fines ($1.5M in Queensland). This created a hostile regulatory environment across the region. [175, 178, 179, 180, 181, 183, 184]

Health Research Concerns: New studies linking vaping to increased diabetes and prediabetes risk emerged, particularly affecting Hispanic, Black, and low-income populations. This medical evidence provided ammunition for regulators and damaged the industry's harm-reduction narrative. [176]

Chinese Supply Chain Disruptions: Reports of illegal Chinese vapes flooding international markets (particularly US) triggered concerns about regulatory crackdowns on Chinese manufacturers and exporters, which dominate APAC-ex-CN production. This threatened the supply chain integrity for the region. [182]

Legitimacy Debate Intensification: Sharp divisions among anti-smoking advocates about vaping's role as a smoking cessation tool, combined with data showing vapers overtaking smokers in developed markets, intensified regulatory scrutiny. The "lesser of two evils" debate failed to provide clear industry support, creating uncertainty. [18, 174, 177]

Special Purpose Acquisition EMEA -9.32%

High-Profile SPAC Fraud and Failures: The Napster case involving a completely fabricated $3 billion investment and Sonder's complete shutdown/liquidation after going public via SPAC severely damaged investor confidence in the SPAC structure and due diligence processes. [185, 186]

eVTOL and Electric Vehicle SPAC Collapses: The electric vertical takeoff and landing (eVTOL) industry, which saw numerous SPAC listings during the pandemic boom, experienced dramatic stock price crashes as companies failed to deliver on promises, burned through cash, and faced certification delays. This represented a broader repricing of speculative SPAC sectors. [16, 187]

Mixed SPAC Deal Activity: While new SPAC deals were announced (Xanadu $3.6B, Einride $1.8B, Enhanced $1.2B, Blockfusion $450M), the contrast between new deals and spectacular failures likely created uncertainty about SPAC valuations and viability, contributing to negative sentiment.

Credibility Crisis in SPAC Sector: The combination of fraud (Napster), operational failures (Sonder, Luminar), and industry-wide collapses (eVTOL) undermined the fundamental value proposition of SPACs as a legitimate alternative to traditional IPOs, leading to broad-based selling pressure across the sector. [16, 185, 186, 187]

Alternative Medicine US -8.52%

Health Misinformation and Credibility Crisis: Multiple stories highlighted concerns about wellness influencers spreading misinformation, antivax content being criticised, and harmful effects from alternative medicine products (particularly the Chinese medicine ointment story), which likely eroded consumer trust in the alternative medicine sector. [94, 96, 148, 173]

Safety Concerns with Popular Supplements: Reports of melatonin potentially harming heart health emerged, which could have reduced demand for this widely-used alternative medicine supplement and created broader concerns about supplement safety. [120]

Regulatory and Scientific Scrutiny: Increased attention to regulatory gaps in alternative treatments (Botox administration) and scientific criticism of alternative medicine claims may have pressured the sector's market performance. [40, 148, 173]

Product Quality Issues: The highly publicised case of a Chinese traditional medicine ointment causing severe skin damage reinforced negative perceptions about quality control and safety in alternative medicine products. [94]

Commodities Equity Performance Dashboard

This dashboard provides performance analytics for global equities with exposure to commodities-related themes in Theia Insights Industry Classification (TIIC), grouped by Industry (level two).

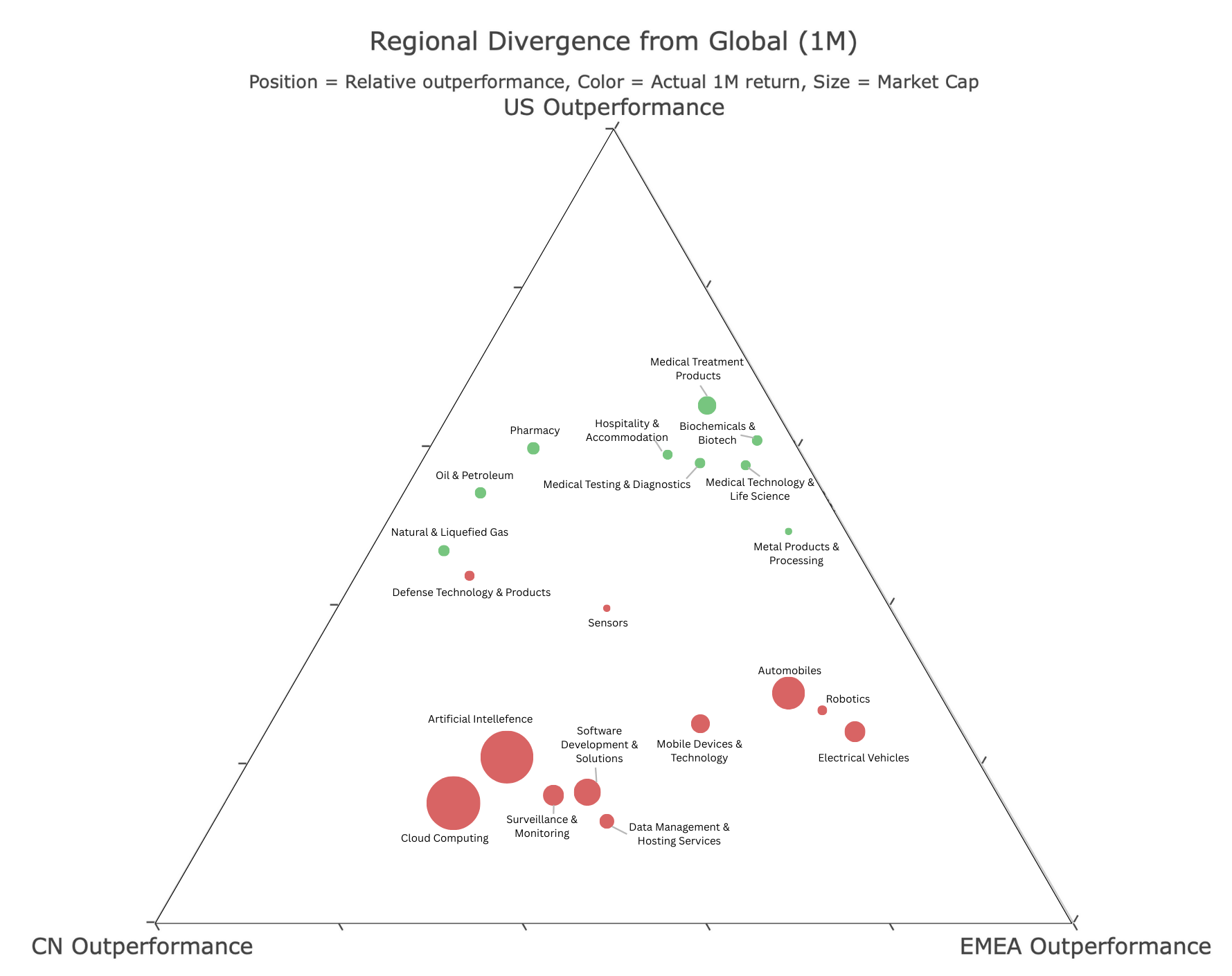

Regional Thematic Performance Overview (Top and Bottom Performing Themes by Region)

This analysis showcases the top three outperforming and underperforming investment themes across major regions, utilising the Theia Insights Industry Classification (TIIC) framework. By examining how identical themes perform differently across geographical markets, this breakdown illuminates the critical impact of regional economic dynamics, regulatory landscapes, and geopolitical developments on thematic investment returns.

Regional Performance Divergence vs Global

Each point's position indicates the relative regional outperformance compared to the global average. The analysis includes tradable portfolios in all three regions, eliminating themes that lack sufficient market presence or liquidity constraints.

Global Sector Thematic Performance (Top and Bottom Performing Themes by Sector)

This dashboard examines thematic investment performance organised by the top-level sectors within the Theia Insights Industry Classification (TIIC) framework. For each sector we report the top 3 and bottom 3 performing themes. By grouping themes under their primary sector classifications, this analysis reveals how broad sectoral trends influence underlying thematic opportunities and risks.

REFERENCES:

[1] Immigrants with obesity, diabetes and other health problems may be denied visas [2] Move over fillers - here's why people are having facial injections made from fish sperm [3] Major UK project launched to tackle drug-resistant superbugs with AI [4] Apple Hit With $634 Million Verdict in Apple Watch Blood Oxygen Patent Lawsuit [5] These families' health care costs will balloon if Congress doesn't act on the ACA [6] Blood Tests for Alzheimer’s Are Here [7] OpenAI is weighing a move into consumer health apps [8] Medicare negotiated lower prices for 15 drugs, including 71% off Ozempic and Wegovy [9] Pfizer files second lawsuit against Metsera, Novo Nordisk [10] New study raises alarms about health impacts and risks of ultra-processed foods [11] White House strikes deal for lower prices on obesity drugs [12] IBM, Cisco Outline Plans For Networks Of Quantum Computers By Early 2030s [13] Global surge in ultra-processed foods sparks urgent health warning [14] Rigetti Stock Falls After Q3 Miss -- But New Quantum Roadmap Sparks 2026 Optimism [15] Routinely giving sugar to a baby is a form of physiological abuse, setting their bodies up for obesity and heart disease later in life [16] The Electric VTOL Aircraft Industry Is Crashing [17] DHS Kept Chicago Police Records for Months in Violation of Domestic Espionage Rules [18] Vaping Is ‘Everywhere’ in Schools—Sparking a Bathroom Surveillance Boom [19] Medicare Premiums In 2026 [20] It's official. Medicare Part B 2026 premium will eat a big chunk of Social Security COLA [21] Why Omada Health is finally prescribing Ozempic as TrumpRx slashes GLP-1 weight-loss drug costs [22] Trump's CZ Pardon Has the Crypto World Bracing for Impact [23] Inside a Wild Bitcoin Heist-Five-Star Hotels, Cash-Stuffed Envelopes, and Vanishing Funds [24] DOJ Issued Seizure Warrant to Starlink Over Satellite Internet Systems Used at Scam Compound [25] Amazon Renames Project Kuiper Satellite Network to Amazon Leo [26] Amazon Renames 'Project Kuiper' Satellite Internet Venture To 'Leo' [27] Medicare premium hike for 2026 will cut heavily into COLA [28] Healthcare ETFs to Buy as Big Pharma Rapidly Integrates AI [29] Main Street market moves-Here's what retail investors have done during a wild week for stocks [30] Elon Musk wants to dominate the in-flight internet market. Here are all the airlines that now offer Starlink WiFi. [31] Sam Bankman-Fried gave the feds an 'unprecedented' sneak peek of his testimony. A court will decide if he gets a trial do-over. [32] Gold's wild rally traps jewelers between soaring costs and cautious customers [33] How the CEO of jewelry company Mejuri is dealing with soaring gold prices [34] China's Galactic Energy fails Ceres-1 rocket satellite mission launch [35] Starlink's direct-to-cell service launches in Ukraine in European first [36] Quantum computers need classical computing to be truly useful [37] Gold's wild rally traps jewelers between soaring costs and cautious customers [38] Pfizer clinches deal for obesity drug developer Metsea after a bidding war with Novo Nordisk [39] 'It's insane'-ACA policyholders say soaring premiums are jeopardizing lives [40] Botox was like going for coffee - I had no idea what went into my body [41] Healthcare ETFs to Buy as Big Pharma Rapidly Integrates AI [42] Popular crypto company shuts down as Bitcoin crashes [43] China Says Mystery Object Appears to Have Struck Ship That Its Space Station Astronauts Were Supposed to Return Home In [44] Trump punches new $35 billion hole in national debt with deal for Medicare to cover your Ozempic [45] Novo continues to look for opportunities in obesity, diabetes, Bloomberg says [46] Fightback-scientists score series of wins in battle against superbugs [47] A pill is raising hope for one of the deadliest cancers. The question is how fast patients should get it. [48] Billionaire Arthur Hayes dumps $2.4M over weekend [49] Popular crypto company files for Chapter 15 bankruptcy as Bitcoin crashes [50] Lilly, Novo near White House deals to cut obesity drug prices, gain Medicare access, media reports [51] GLP-1s for Alzheimer's-Novo Nordisk announces trial conclusion [52] A Diabetes Device You’d Actually Want to Carry Every Day [53] Bitcoin Erases Year's Gain as Crypto Bear Market Deepens [54] Harvard Has Almost Half a Billion Dollars in Crypto [55] Retail Traders Left Exposed in High-Stakes Crypto Treasury Deals [56] World's Central Banks Are Wary of AI and Struggling To Quit the Dollar, Survey Shows [57] Brussels weighs banning China from major EU research scheme [58] China's Stranded Astronauts Show the Dangers of Space Junk [59] Alarm Grows over Proposed Giant Mirrors in Orbit and Other Commercial Space Plans [60] Rocket Lab's Neutron slips to 2026-'Our aim is to make it to orbit on the first try' [61] Nobel laureate Paul Krugman says Bitcoin’s meltdown is deeply connected to Trump’s waning power [62] Private Chinese rocket fails during launch, 3 satellites lost [63] Bitcoin’s earliest billionaire empties entire portfolio after market crash [64] Crypto Whales Switch Sides-What Do They Know That the Market Doesn’t? [65] Bitcoin Whales Dump 29,400 BTC at a Loss — But Analysts Say Stay Calm [66] A look at Rigetti Computing and D-Wave Quantum, whose shares have surged over 1,900% in the past year as the potential of quantum computing captivates investors (Felice Maranz/Bloomberg) [67] Toronto-based quantum computing company Xanadu says it will go public in the US and Canada via a SPAC, in a deal that values the combined business at ~$3.6B (Josh Scott/BetaKit) [68] Rocket Lab delays debut of powerful, partially reusable Neutron rocket to 2026 [69] Trump Family Fortune Plummets in Stinging Crypto Crash [70] Superconducting qubit that lasts for over 1 millisecond is primed for industrial scaling [71] China to Launch Rescue Shenzhou-22 Spacecraft for Stranded Astronauts [72] Why are biologic drugs expensive? Will Trump’s plans make them cheaper? [73] Bitcoin rises above $90,000 as cryptocurrency attempts recovery amid stock market gains [74] 'Shockingly large' amount of sensitive satellite communications are unencrypted and vulnerable to interception, researchers find [75] Chinese astronauts to get replacement spacecraft after debris strike leaves them without a ride home [76] One of the world’s fastest power banks got a Black Friday discount [77] Bitcoin Touches $93K Low as Market Sentiment Hits Extreme Fear [78] Robert Kiyosaki warns the ‘biggest crash in history’ is starting, says millions to ‘lose everything.’ How prepare now [79] ‘Rich Dad Poor Dad’ author sets new Bitcoin, Ethereum, gold price targets [80] Startup Omada Health to start prescribing GLP-1s, other obesity medications as membership grows [81] Rick Harrison said this 1 shiny asset has gone ‘absolutely nuts’ as governments are ‘buying it all’ [82] Speech-restoring brain chip gets FDA approval for human trial [83] Wireless, laser-shooting, brain implant fits on a grain of salt [84] Smart health-tracking earrings measure blood flow to your head [85] Pfizer wins bidding war for Metsera with $10B offer [86] IBM goes all-in on quantum chips - new Nighthawk and Loon hardware look to bring the dream to life at last [87] A new threat landscape is coming - this security firm CEO thinks nation-states will have weaponized quantum computers within the next five years [88] Terror group Palestine Action like the suffragettes, court hears [89] US judge says Trump cannot deploy National Guard to Portland [90] Pence group blasts Trump's drug pricing plan as 'socialist' in new ad campaign [91] GLP-1 weight-loss medications linked to improved cancer survival in certain patients [92] Bitcoin’s Price Falls To 7-Month Low, But Here’s The Silver Lining [93] China’s Offer to Store Foreign Gold Gets Taken Up By Cambodia [94] China Quality Ointment Gives Woman’s Skin Snake-Like Patterns [95] Semaglutide Fails to Slow Alzheimer's in Major Trials [96] Modern-Day Snake Oil-How Wellness Influencers Gained the Power to Spread Health Misinformation [97] Gold price dips as US Fed interest rate cut expectations fall [98] White House announces deal to lower weight loss drug prices for many Americans [99] Black Friday deals on chargers and power banks we love from Anker and more [100] Monarch Tractor Preps For Layoffs and Warns Employees It May 'Shut Down' [101] BYD's largest Chinese megafactory dwarfs Tesla's Austin site. Satellite images show it's getting even bigger. [102] Tesla's Cybertruck lead is leaving the company after 8 years [103] Anker Selling 30W Power Bank for Pocket Change, 10,000mAh Battery Pack Now Costs Almost Free [104] Anker Handed Amazon Millions of MagSafe Power Banks to Clear, Now Going for Black Friday Record Low [105] EcoFlow Decided Profit Doesn’t Matter, 1800W Power Station Hits New All-Time Low for Winter Backup [106] Amazon Clears Out This 20,000mAh 87W 3-Port Power Bank, Now Selling for Pennies [107] Amazon Offloads Delta 2 Power Station, EcoFlow’s 1800W Unit Goes for Nearly Free [108] Amazon Drops Its First Major Black Friday Deal on a Power Station, Now Selling for Pennies at 1500W Output [109] Jackery Decided Margins Don’t Matter, 300W Power Station Now Cheaper Than Fancy Power Banks [110] Anker Goes Zero-Margin on Solix 2000W Power Station, Game Over for EcoFlow and Jackery [111] Amazon Slashes This 1500W Power Station to Peanuts, 7 Outlets Save You During Winter Blackouts [112] QuantumScape Corporation-Solid-State Revolution Is Here [113] GM Drives 5,000 Miles to Test Its EVs — and Finds a Major Charging Issue [114] China’s BYD aims to sell up to 1.6 million vehicles abroad in 2026, Citi says [115] Toyota Says Its Next EV Batteries Will Last 40 Years — And They’re Almost Ready [116] Exclusive-GM wants parts makers to pull supply chains from China [117] Bloom Energy (BE) Is Down 19.6% After Striking New Oracle AI Data Center Power Deal — Has The Bull Case Changed? [118] Ford CEO Farley considers drastic decision after $1.4 billion loss [119] This Major Energy Company Is Blaming The White House For Its Bankruptcy [120] 7 Melatonin Alternatives, if the Popular Sleep Aid Isn’t Helping You Rest [121] Apple just delayed the iPhone Air 2 indefinitely, report says [122] The Data Center Resistance Has Arrived [123] The 4 Things You Need for a Tech Bubble [124] The Trump Administration’s Data Center Push Could Open the Door for New Forever Chemicals [125] RAM prices are so out of control that stores are selling it like lobster [126] The AI industry is running on FOMO [127] The AI bubble you haven't heard about [128] Malaysia's Johor Bans Low-Tier Data Centers Over Water Strain [129] 'Stratospheric' AI Spending By Four Wealthy Companies Reaches $360B Just For Data Centers [130] Fund Managers Warn AI Investment Boom Has Gone Too Far [131] Google Must Double AI Serving Capacity Every 6 Months To Meet Demand [132] The spike in data centers is one of the main contributors to electricity demand and blackout risks this winter [133] Amazon's AI capacity crunch and performance issues pushed customers to rivals including Google [134] AI is winning over consumers — but it's way behind with businesses, say Goldman Sachs analysts [135] A data center is being built in my neighborhood. It's inevitable, but I'm devastated about what it could do to my community. [136] Mark Cuban warns the AI wars could end like the search engine crash — with one winner and a lot of losers [137] Mitigating the Public Health Impacts of AI Data Centers [138] Data Centers in Nvidia’s Hometown Stand Empty Awaiting Power [139] AI data center projects drive up memory chip prices. Here's why. [140] UK world's most expensive place to develop nuclear power, report finds [141] US criticises Britain over nuclear reactor proposals [142] Nuclear Stocks Crash, With A Potential Payoff Still Years Away [143] AI Nuclear Energy Stocks to Now Buy On the Dip-CEG, GEV [144] La mayor central nuclear de Europa vive conectada a generadores diésel desde hace un mes. Es tan alentador como suena [145] ESPN Bet is shutting down, and now ESPN is partnering with DraftKings [146] Cleveland Guardians’ pitchers indicted for rigging online bets [147] Amazon Renames Project Kuiper Satellite Network to Amazon Leo [148] Antivaxxer Steve Kirsch unknowingly identifies the fatal flaw of an antivax “report” from the McCullough Foundation [149] Amazon Renames Project Kuiper Satellite Network to Amazon Leo [150] Apple reportedly preps more iPhone satellite features, and Elon Musk's SpaceX may power them [151] Amazon’s Starlink-style satellite internet project just got a new name [152] What is Amazon Leo, the e-commerce giant’s rival to Starlink? [153] ViaSat (VSAT) Tops Q2 Earnings Estimates [154] Globalstar (NASDAQ-GSAT) Reports Upbeat Q3 [155] SpaceX Buys More Spectrum for Direct-to-Cell From EchoStar [156] T-Mobile Launches Free Text-to-911 via Satellite for Everyone [157] Europe backs secure satellite communications with multibillion euro package [158] BlackSky signs contract exceeding 30 million dollars to supply Gen-3 ISR for defense client [159] BlackSky to deliver advanced Gen-3 tactical ISR capabilities to international customer [160] SpaceX to Acquire EchoStar AWS-3 Spectrum Licenses in $2.6 Billion Stock Deal [161] Amazon Leo Declares War On SpaceX's Two-Thirds Satellite Dominance [162] Exclusive interview-OneWeb eyes Asia-Pacific as key growth engine in the global satellite race [163] Taiwan launches homegrown satellite constellation to replace aging defense comms [164] Taiwan to launch first satellite in FORMOSAT-8 constellation aboard SpaceX Falcon 9 [165] Research insight-Direct-to-device poised to redefine mobile-satellite integration [166] Amazon rebrands Kuiper as 'Amazon Leo' and begins satellite network trials [167] Fossil fuel emissions rise again - but renewables boom offers hope for climate [168] The world's most powerful militaries in 2025, ranked [169] A 'Peak Oil' Prediction Surprise From the International Energy Agency [170] Welcome to the planet’s newest oil frontier [171] IEA Now Predicts Oil and Gas Demand Will Rise beyond 2030, Departing from Previous Forecasts [172] Fossil fuel emissions rise again – but China's are levelling off [173] The CDC is lying to you about vaccines and autism [174] Can vaping help wean people off cigarettes? Anti-smoking advocates are sharply split [175] Maldives bans smoking for younger generations [176] New study finds hidden diabetes danger in vaping [177] Vapers overtake smokers for first time in Britain [178] Brickbat-Puff?Pass [179] Putin approves idea of total vape ban [180] Asian nation introduces lifetime smoking ban for Gen Z and beyond [181] Maldives becomes only nation with generational smoking ban [182] Poll-Americans Fed Up With Illegal Chinese Vapes Flooding the Country, Many Funneled Through Florida [183] Vape vendors open in country towns despite strengthened laws [184] Illegal tobacco retailer hit with $1.5m fine following Queensland sting [185] Napster Said It Raised $3 Billion From a Mystery Investor. But Now the 'Investor' and 'Money' Are Gone [186] Sonder Shuts Down After Marriott Termination, Marking the End of a Hospitality Experiment [187] Luminar is fighting with its biggest customer as bankruptcy threat loomsGet In Contact

press@theiainsights.comAbout Theia Insights

Theia Insights is a deep tech company based in Cambridge (UK), building foundational AI for the global investment community. We are a team of PhD scientists, engineers, mathematicians, and industry practitioners offering clients future-proof solutions in Industry Classification, Thematic Risk Models, and Portfolio Analytics. Named after the goddess of sight, Theia synthesises and distils vast amounts of financial information so investors can see more clearly. To learn more, visit www.theiainsights.com.