January 2026 Performance Synopsis

January delivered exceptionally strong returns across industrial, materials, and defence-related themes, while technology and consumer-facing sectors experienced notable weakness. The market showed a clear preference for tangible, hard-asset businesses over digital and software-oriented plays.

Best Performing Themes

Aerospace & Science Satellites +25.61%

Major New Satellite Constellation Announcements: Blue Origin's TeraWave announcement with 5,400+ satellites positioned as a direct Starlink competitor represented a significant validation of the satellite communications market and increased competitive intensity, signalling billions in future investment and infrastructure deployment. [1, 8, 12]

Expansion of Satellite Applications Beyond Communications: SpaceX's unprecedented filing for 1 million solar-powered orbital data centres for AI applications demonstrated the potential for satellites to serve entirely new markets beyond traditional communications, significantly expanding the addressable market and revenue potential for the sector. [2, 3]

Government Investment and National Security Focus: Japan's formal commitment to building its own LEO constellation and the US Space Force's $52 million deorbiting contract showed increasing government recognition of satellites as critical national infrastructure, driving sustained public sector investment and creating new service categories. [5, 9]

Commercial Space Station Development: The imminent launch of first commercial space stations in 2026 signalled the beginning of a broader commercial space economy in low Earth orbit, creating new demand for satellite services, launch capabilities, and orbital infrastructure beyond traditional applications. [4]

Continued Launch Cadence and Infrastructure Development: Multiple successful SpaceX Starlink launches and Rocket Lab missions throughout January demonstrated robust operational execution and ongoing constellation expansion, while development progress on next-generation systems like Neutron showed sector momentum despite technical challenges. [6, 7, 10, 11]

Space Exploration +23.00%

Historic ISS Medical Evacuation Successfully Managed: The first-ever medical evacuation from the International Space Station in its 25-year history was executed successfully, with Crew-11 returning safely. While highlighting operational risks in space exploration, the successful emergency response demonstrated NASA and SpaceX's crisis management capabilities and operational resilience. [13, 14, 15, 17, 18, 24, 25, 26]

Artemis II Lunar Mission Momentum Building: NASA announced concrete plans for Artemis II with a potential February 6 launch date, marking humanity's return to deep space after over 50 years. The mission rollout and timeline announcements generated significant positive sentiment around the revival of crewed lunar exploration and NASA's deep space capabilities. [16, 22, 23, 27, 28, 29]

Commercial Space Economy Expansion: Multiple developments indicated robust growth in the commercial space sector, including first commercial space stations planned for 2026, multiple private lunar lander missions scheduled, Blue Origin's satellite constellation plans, and NASA's commitment to lunar infrastructure including a nuclear reactor by 2030. This demonstrated expanding opportunities beyond traditional government-led missions. [1, 4, 30, 31, 32]

Operational Continuity Despite Challenges: NASA demonstrated operational flexibility by accelerating the Crew-12 launch to February 11 and maintaining ISS operations with a skeleton crew. Leadership statements confirmed the medical evacuation would not interfere with the Artemis II timeline, providing reassurance around program continuity and risk management. [15, 16, 18]

Nuclear Energy +21.14%

Big Tech AI Power Demand: Major technology companies, particularly Meta, announced multiple large-scale nuclear energy deals totalling up to 6.6 GW to power AI data centres. This created unprecedented corporate demand for nuclear energy and demonstrated a structural shift in electricity consumption patterns driven by AI workloads. [34, 39, 42, 44, 45, 46, 48]

Trump Administration Pro-Nuclear Policy: President Trump's promise of three-week approval timelines for nuclear plants at Davos caused immediate stock rallies, while his administration pushed for accelerated plant construction and streamlined regulatory processes, signalling strong federal support for nuclear energy expansion. [41, 43, 47]

Policy Reversals and Nuclear Renaissance: Germany's chancellor publicly admitted the nuclear shutdown was a "huge mistake," while Japan restarted the world's largest nuclear plant after 15 years. These moves indicated a global policy shift back toward nuclear energy as countries reassessed energy security priorities. [33, 37, 38]

Government Investment and Strategic Initiatives: The US committed $2.7 billion to uranium enrichment capacity, NASA pledged to build a nuclear reactor on the Moon by 2030, and the DOE offered Nuclear Lifecycle Innovation Campuses, demonstrating substantial government investment across the nuclear value chain. [31, 40, 36]

Bullish Investor Sentiment: Wall Street analysts positioned uranium as "the next gold and silver trade" while recommending nuclear stocks as top investments for 2026, reflecting strong institutional confidence and sustained momentum across the sector. [34, 35]

Electronic Components +20.81%

Supply Chain Constraints and Pricing Power: Critical shortages in memory chips and glass cloth components created persistent supply-demand imbalances, enhancing pricing power for electronic component manufacturers with impacts expected to continue through 2027. [49, 50]

AI-Driven Semiconductor Demand: Surging demand for AI-related components including ASICs and advanced processors drove strong sector-wide growth, with companies such as Broadcom expecting shipments to triple as AI infrastructure scales. [52, 53]

Advanced Manufacturing Progress: Major semiconductor manufacturers demonstrated progress in next-generation process technologies, including Intel’s 14A and 18A nodes, signalling industry health and continued innovation across electronic components. [51, 52]

Trade Policy and Supply Chain Restructuring: New tariffs on high-end chips and Taiwan’s large-scale US manufacturing commitments created both challenges and opportunities, potentially benefiting component suppliers positioned to capitalise on supply chain realignment. [54, 55]

Testing & Inspection Equipment +19.90%

Strong Semiconductor Testing Equipment Demand: Major testing and inspection equipment manufacturers reported record results and raised forecasts, with Advantest shares jumping on record sales and AI-driven demand, while KLA Corporation received analyst upgrades on improving revenue and EPS outlooks. [56, 57, 58, 68]

Bullish Analyst Sentiment on Inspection Equipment Leaders: Multiple analysts upgraded or raised price targets on leading companies, including ASML, with firms citing strong secular and cyclical drivers and calling 2026–27 “big years” for inspection equipment growth. [59, 61, 63, 64]

AI and Advanced Technology Integration: Strong momentum emerged from AI-driven inspection systems and advanced semiconductor node requirements, with reports highlighting rapid growth in AI visual inspection, wafer inspection markets, and AI-enabled defect detection solutions. [56, 60, 62, 67]

Expanding Market Opportunities Across Segments: Research identified substantial growth opportunities across multiple inspection equipment segments, including surface vision, wafer fab equipment, and non-destructive testing for aerospace, defence, and advanced manufacturing applications. [60, 65, 66, 67]

Worst Performing Themes

Software Development & Solutions -13.39%

AI-Driven Automation Threat: Multiple sources indicate AI tools are rapidly automating software development tasks, with predictions that software engineering will be fully "automatable" within 12 months. This creates existential uncertainty about demand for traditional software development services and threatens the core business model of software solutions companies. [69, 72, 73, 74, 77, 78, 79, 81, 83]

Investor Sentiment Collapse on SaaS/Software Stocks: Bond and equity investors are actively selling software company securities due to fears that AI innovations will "upend their business models." Reports specifically cite Adobe, Oracle, and other major software stocks halving in value despite the broader AI boom, indicating a fundamental repricing of the sector. [76, 80, 82]

Mass Layoffs and Reduced Hiring: Major tech companies are conducting significant layoffs of software engineers (Amazon: 16,000 employees), while industry leaders publicly state they're "done with hiring humans" and replacing development teams with AI agents. This signals both weak demand and a structural shift away from human-based software development. [71, 75]

Productivity Revolution Threatening Headcount Models: AI coding tools enabling single developers to produce output equivalent to entire engineering teams fundamentally threatens the staffing-based revenue models of software development and solutions companies. The dramatic increase in developer productivity reduces the total addressable market for software services. [70, 73, 78]

Gambling -10.42%

Regulatory and Legal Headwinds: Multiple states and federal authorities are increasing scrutiny of gambling operations, with Maine filing lawsuits against iGaming, governors proposing gambling addiction programs while expanding casinos (creating regulatory uncertainty), and new age verification requirements for online gaming platforms. This regulatory pressure creates significant uncertainty for gambling operators' business models and growth prospects. [84, 93, 97]

Youth Gambling and Ethical Concerns: The introduction of gambling-style mechanics and microtransactions in popular games like Fortnite that reach millions of children has raised serious ethical and regulatory red flags. This crossover between gaming and gambling, particularly targeting youth, increases the risk of legislative action and public backlash against the industry. [88, 89, 97]

Market Saturation and Sustainability Concerns: Evidence suggests the sports betting and prediction markets boom may be reaching unsustainable levels, with poor odds compared to traditional gambling, college betting scandals damaging integrity, media questioning the prediction market obsession, and concerns about gambling becoming an "epidemic." These factors suggest market maturation and potential user attrition. [85, 86, 87, 90, 94, 96]

Negative Analyst Sentiment and Industry Weakness: Direct analyst calls on major gambling stocks like DraftKings, struggling sports gambling companies requiring political intervention to survive, and growing public awareness of gambling addiction risks all contributed to negative investor sentiment toward the gambling sector in January. [91, 92, 95]

Artificial Intelligence -9.84%

Slower-than-Expected Enterprise Adoption: Major institutional investors and enterprises showed hesitancy in adopting generative AI, with over half of Wall Street data investors not yet beginning their AI journey, raising concerns about near-term revenue growth for AI companies. [76, 99]

Quality and Value Concerns: Multiple studies revealed that while AI increases output volume, it reduces quality, diversity, and collaboration in research and creative work, questioning the long-term value proposition of AI tools and potentially dampening investor enthusiasm. [98, 101, 107]

Technical Limitations and Safety Issues: Research highlighting mathematical limitations of AI agents, misalignment problems in fine-tuned models, and implementation failures created uncertainty about AI's ability to deliver on its promises, contributing to negative sentiment. [102, 103, 106]

Industry Pushback and Resistance: Significant resistance from key user groups including game developers (52% negative), creative professionals, and concerns about AI disrupting existing software business models led to bond sell-offs and broader market concerns about AI monetisation. [76, 100, 105]

Commoditisation Fears: Evidence that AI can match or exceed human performance on certain tasks, combined with concerns about "AI slop" and quality degradation, may have raised fears about rapid commoditisation reducing profit margins for AI companies. [104, 107]

Data Management & Hosting Services -9.22%

Infrastructure Reliability and Operational Failures: Multiple high-profile outages (TikTok data centre power failure, service disruptions) undermined confidence in data centre reliability and operational excellence, raising concerns about service quality and business continuity. [108, 111, 114]

Supply Chain Constraints and Capacity Challenges: Intel's inability to meet AI data centre demand (resulting in 13% stock drop) and struggles with manufacturing yields signaled critical supply-side bottlenecks that could limit sector growth and profitability. [109, 115, 116]

Rising Operational Costs and Regulatory Pressure: Utilities requesting $31 billion in rate increases, pressure on tech companies to fund their own power infrastructure, and community backlash against data centres created significant cost inflation concerns and regulatory headwinds. [41, 110, 113, 117, 120]

Credit and Financing Concerns: Wall Street's diminishing appetite for Oracle's data centre debt and concerns about Microsoft's budget overruns indicated tightening credit conditions and investor skepticism about returns on massive capital expenditures. [112, 113]

ESG and Community Resistance: Microsoft's water usage controversies, broken environmental pledges, and widespread community opposition to data centre projects (25+ projects canceled in 2025) created reputational risks and potential regulatory obstacles. [110, 118, 119, 121]

Quantum Technology -8.86%

Valuation Correction and Bubble Concerns: Multiple articles warned about overvaluation, comparing quantum stocks to AI hype and questioning sustainability. IonQ's 50% decline exemplifies sector-wide correction as investors reassessed speculative valuations against distant commercialisation timelines. [123, 126, 133, 135, 139, 140]

Technical Delays and Commercialisation Challenges: Rigetti's announced quantum computing delay damaged sector credibility, while research showing quantum computers may require more power than supercomputers and have security vulnerabilities raised questions about near-term practical viability. [127, 128, 138]

Dilution Risks and Capital Needs: D-Wave's $330M shelf offering and the $840M warning about quantum stocks highlighted ongoing capital requirements and dilution concerns, suggesting these companies remain far from profitability and will need continuous funding. [123, 137]

Mixed M&A and Funding Signals: While IonQ's $1.8B acquisition of SkyWater and Photonic's $130M raise showed continued activity, these moves also underscored the capital-intensive nature of quantum computing and raised questions about whether consolidation reflects strength or desperation. [129, 136]

Speculative Sentiment Shift: The proliferation of "millionaire-making" and "stocks to buy" articles, coupled with strong negative rebuttals, suggests the sector experienced a classic speculative peak followed by reality check as investors questioned whether quantum computing would become "the AI stocks of 2026" or a cautionary tale. [122, 124, 125, 126, 130, 131, 132, 133, 134]

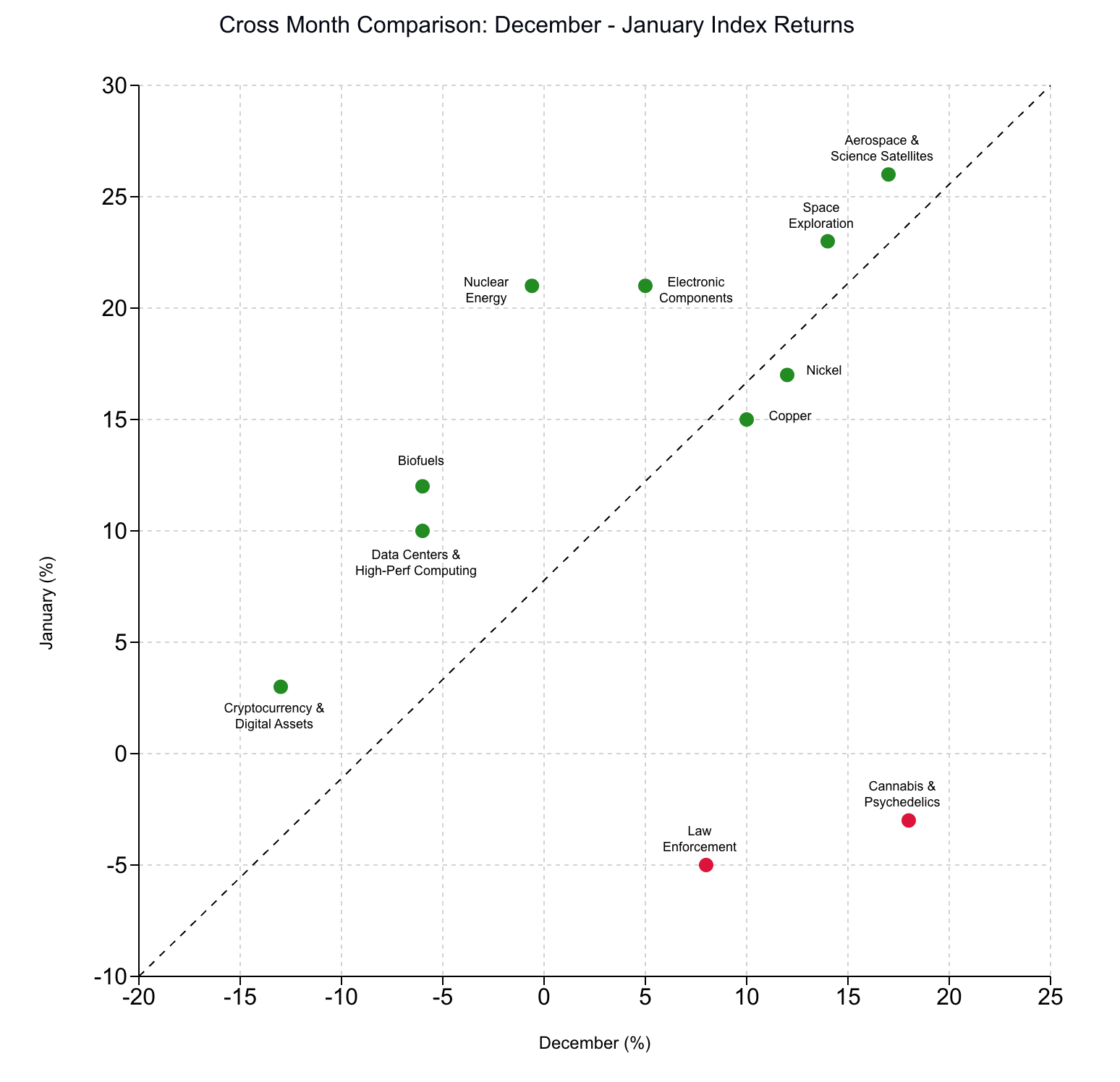

Cross-Month Comparison

In January, previous winners in Aerospace & Science Satellites and Space Exploration extended their momentum, while Nuclear Energy surged from losses to lead gains, reflecting shifting sentiment on energy security. Industrial metals like Nickel and Copper remained strong, and Electronic Components and Data Centers rebounded sharply, signalling renewed optimism in semiconductors and AI infrastructure. By contrast, volatile sectors such as Cannabis & Psychedelics and Law Enforcement reversed course, and Cryptocurrency staged a modest recovery. Overall, the month highlighted continued sector rotation, speculative swings, and targeted investor interest across technology, energy, and industrial themes.

Interesting Themes from Cross-Month Comparison

Cannabis & Psychedelics Dec +17.95% → Jan -2.92%

Federal Policy Stagnation: The most significant driver was stalled federal cannabis policy in the US, which caused the MSOS cannabis ETF to drop 26% in one month, directly explaining the sector's negative January performance after December gains. [144]

Regulatory Threats and Uncertainty: Multiple regulatory challenges emerged including potential restrictions on THC beverages, threats to repeal marijuana legalisation in multiple states, and quality control issues with hemp substitution in legal products, creating significant uncertainty for investors. [141, 142, 143, 148]

Market Oversupply and Price Collapse: Reports of massive cannabis oversupply in the US leading to price collapses and large-scale smuggling to Europe indicated fundamental market imbalances that would pressure revenues and margins for cannabis companies. [145, 149]

Weakening Medical Cannabis Thesis: New scientific evidence showing insufficient support for cannabis treating nerve pain, combined with warnings about serious side effects like cannabis hyperemesis syndrome, undermined the medical justification for cannabis products and could affect both regulatory support and consumer demand. [146, 147]

Quality and Safety Concerns: Investigations revealing widespread substitution of hemp for marijuana in legal dispensaries and contamination issues raised serious questions about product quality and regulatory oversight in the legal cannabis market, potentially eroding consumer and investor confidence. [142, 143]

Nickel Dec +11.57% → Jan +17.08%

Supply Constraints and Production Cuts: Indonesia, the world's largest nickel producer, cut mining quotas to support prices, while Australian nickel mines remained closed with uncertain restart prospects. These supply-side restrictions created upward price pressure. [152, 155, 156]

Strong Industrial Demand: Robust demand driven by electrification, AI infrastructure, and nickel smelting operations (particularly coal-fired captive power for smelters in Indonesia) supported higher prices despite rising inventories. [154, 158]

Broader Metals Market Momentum: Bullish sentiment across industrial metals markets, driven by lower interest rates, supply concerns, and strong trading volumes, lifted nickel along with copper and other base metals. [153, 154]

Processing and Value Chain Developments: Government incentives for nickel processing (India) and ongoing project developments (Canada) signalled positive long-term demand outlook and strategic importance of nickel in supply chains. [151, 157]

Copper Dec +10.31% → Jan +15.16%

Record-Breaking Price Levels and Supply Constraints: Copper prices surged to record highs above $13,000/ton driven by severe supply constraints including strikes at Chilean mines, dwindling warehouse stocks, and chronic underinvestment in new mining capacity. Inventories became "locked in the US" due to tariff uncertainty, creating supply tightness. [159, 163, 164, 167, 168, 172, 174]

AI and Data Centre Demand Surge: Explosive demand from AI infrastructure, data centres, and cloud computing emerged as a major new driver. Amazon's deal with Rio Tinto for Arizona copper mine supply exemplifies how tech giants are securing copper for massive data centre expansion, adding unprecedented demand to traditional uses. [154, 159, 160, 161, 162, 166, 169, 170, 175]

Structural Supply-Demand Imbalance: S&P Global's analysis predicting copper demand will increase 50% by 2040 while supply faces 15-year shortfall created strong bullish sentiment. The market recognised copper shortage as a "systemic risk" to the economy, with refined copper supply deficits forecast through 2027, fundamentally supporting higher prices. [165, 166, 169, 172, 173, 175]

Electrification and Green Energy Transition: Strong demand from electric vehicles, renewable energy infrastructure, and grid expansion drove structural long-term demand growth. Combined with AI demand, this created "ubiquitous" demand across multiple high-growth sectors simultaneously. [154, 159, 160, 170, 171, 176]

Speculative and Trade Policy Factors: Expectations of Trump administration tariffs on refined metals triggered a rush to import copper into the US, with speculative funds driving prices higher. This created short-term price momentum on top of fundamental supply-demand tightness. [164, 168, 174]

Data Centers & High-Performance Computing Dec -6.21% → Jan +9.57%

Policy Support and Power Infrastructure Investment: Trump administration and bipartisan governors pushed for new power plant auctions and policies requiring tech companies to pay for their own electricity, reducing concerns about consumer utility bill increases. This policy clarity likely boosted investor confidence in sustainable sector growth. [41, 177, 183]

Massive Capital Commitments from Tech Giants: Meta announced plans for "hundreds of gigawatts" of AI capacity and signed multi-gigawatt nuclear deals, while Nvidia invested $2B in CoreWeave and Blackstone reported strong returns from its $1.3 trillion data centre portfolio. These commitments validated long-term demand fundamentals. [42, 178, 179, 181, 182]

Strong Institutional and Market Validation: Blackstone's significant returns from data centre investments and continued institutional capital flows demonstrated proven profitability, offsetting earlier concerns about speculative AI infrastructure spending. [178, 180]

Power Infrastructure Solutions Emerging: Major deals for nuclear power (Meta) and alternative energy solutions (Bloom Energy's $2.65B deal) addressed previous concerns about power constraints, showing the sector is actively solving its biggest bottleneck. [42, 180, 182]

Regulatory and Environmental Headwinds Partially Offset: While data centres contributed to rising US emissions (2.4% increase) and utility rate hike requests ($31B), policy frameworks requiring tech companies to self-fund infrastructure mitigated some investor concerns about regulatory backlash. [19, 41, 184, 185, 177]

Cryptocurrency & Digital Assets Dec -13.18% → Jan +3.05%

Market Bottoming and Deleveraging: Bitcoin open interest crashed to 2022 levels (down 31% from peak), indicating significant deleveraging and position liquidation that cleared out weak hands. Multiple institutional analysts (Bernstein, others) called a market bottom, signalling the December sell-off had exhausted itself and creating conditions for January's recovery. [187, 189, 192, 196, 204]

Institutional Capital Inflows: BlackRock's Bitcoin ETF recorded its largest inflow in three months, demonstrating renewed institutional buying interest. This represented a sharp reversal from the December outflows and profit-taking that had pressured prices lower. [201, 202]

Major Institutional Adoption Signals: Fidelity Investments ($6 trillion AUM) announced plans to launch its FIDD stablecoin on Ethereum, representing massive institutional validation of crypto infrastructure. BitGo's successful IPO pricing above range further signalled institutional confidence returning to the sector. [190, 195, 197, 200]

Regulatory Clarity Progress: The CLARITY Act gained momentum in Congress, providing optimism about clearer regulatory frameworks. While disputes over DeFi remained, the overall trajectory toward legislation reduced regulatory uncertainty that had weighed on December performance. [198, 199]

Technical Breakouts and Sentiment Shift: Bitcoin broke from a 6-week bear pattern and reclaimed the $95,000 level, triggering technical buying. Prominent figures like CZ predicted a "super-cycle" while analysts from Standard Chartered and ARK issued bullish long-term targets ($40K ETH, $800K BTC), shifting sentiment from December's pessimism. [186, 188, 191, 193, 194, 203]

Region Best/Worst Performing Themes

Metal & Mineral Mining CN +28.86%

Historic Precious Metals Price Rally: Gold surged past $5,000-$5,600 and silver broke through the milestone $100 barrier (reaching as high as $120), representing unprecedented price levels that directly drove mining company valuations and the 28.86% sector return. This was described as a "breathtaking" and historic rally. [205, 206, 215, 217, 221, 229, 231]

Extreme Volatility and Price Corrections: The sector experienced dramatic volatility with silver crashing 25-35% and gold tumbling 12-25% at various points, creating a "dangerous phase" characterised by rapid unwinding of precious metals trades. This volatility, while creating risk, also generated trading opportunities and reflected intense market activity. [207, 222, 224]

Safe-Haven Demand and Geopolitical Uncertainty: "Sell America" sentiment, US-Europe tensions over Greenland, Trump's tariff threats, and general global uncertainty drove massive safe-haven flows into precious metals. Gold became increasingly viewed as a "hedge against Trump" and his "absolute unpredictability," fueling record inflows. [205, 217, 218, 221, 230, 231]

Weakening US Dollar: The dollar's retreat to 4-month lows and general weakness provided a tailwind for precious metals prices, as they typically move inversely to the dollar. This currency dynamic was a key factor supporting the metals rally throughout the period. [217, 220, 224, 226, 227]

Strong Analyst and Institutional Support: Multiple major banks (BofA, RBC Capital, Scotiabank, H.C. Wainwright) raised price targets and upgraded mining stocks to outperform ratings, while prominent investors like Jim Cramer endorsed specific mining companies as "best in class," indicating strong institutional conviction in the sector. [212, 214, 219, 223, 228, 233]

Industrial and Investment Demand Convergence: The "perfect storm" for silver combined booming speculative demand with strong industrial demand (particularly from technology and renewable energy sectors), while copper, zinc, and aluminum also saw upside from supply constraints and supportive policies. [213, 216, 230]

Metal Products & Processing CN +25.51%

Advanced Metal Processing Technology Innovation: Growing adoption of sophisticated metal processing technologies including 3D metal printing, laser etching, and CNC machining is driving sector performance. Companies are investing in automation and precision manufacturing capabilities to offset cost pressures and meet demand for specialised metal products. [234, 236, 237, 238]

Premium Material Demand from Tech Sector: Strong demand for advanced metal alloys and specialised materials from technology manufacturers, particularly for consumer electronics like foldable phones using liquid metal and titanium alloys, is boosting the metal products sector. [235, 239]

Manufacturing Digitalisation and Automation: Industry focus on smart manufacturing, digital transformation, and automated production lines for metal fabrication is enhancing productivity and competitiveness, as evidenced by major industrial conferences and technology demonstrations. [238, 240]

Supply Chain Resilience Despite Cost Pressures: Metal processing companies are successfully navigating 10-15% supplier price increases through technological innovation and advanced manufacturing techniques, maintaining quality while managing inflation. [238]

Process Optimization & Automation US -13.35%

Weak ROI Evidence and Productivity Concerns: Multiple reports questioned the actual value delivery of automation and AI tools, with Deloitte finding AI hasn't helped bottom lines, Forrester noting AI is "nowhere in productivity statistics," and research showing minimal time savings from automation tools. This undermined investor confidence in the sector's value proposition. [244, 248, 252]

Enterprise Cost-Cutting Over Technology Investment: Major corporations announced significant layoffs (Amazon 16,000 cuts, Microsoft layoffs, Nike 775 cuts, Ubisoft closures) while citing operational streamlining and cost reduction, suggesting enterprises are prioritising workforce reduction over automation technology spending in uncertain economic conditions. [241, 242, 243, 247, 250]

Weak Enterprise Demand and Spending: Tepid demand from US enterprises affected IT services firms, RBC downgraded UiPath citing sector divergence, and ServiceNow stock fell despite earnings beat, all indicating softening enterprise spending on process automation and workflow solutions. [245, 246, 249]

Market Skepticism on Automation Value: Analysts and investors increasingly questioned whether process automation investments deliver sufficient returns, with research highlighting minimal productivity gains and companies struggling to demonstrate clear financial benefits from automation initiatives. [248, 251, 252]

Luxury Fashion & Accessories EMEA -8.80%

Luxury Retail Distribution Crisis: Major bankruptcy of Saks Global (owner of Saks Fifth Avenue, Neiman Marcus, Bergdorf Goodman) created significant disruption in luxury brand distribution channels, with hundreds of millions owed to brands like Chanel and Burberry, likely impacting revenue collection and market confidence. [150, 208, 209, 253, 254]

Trade Policy and Tariff Threats: Trump administration's threat of 200% tariffs on French wines caused LVMH shares to drop 3%+ and Bernard Arnault to lose $12.5B, creating broader uncertainty for European luxury goods exports and EMEA-based luxury conglomerates. [210]

Brand Value Concerns: Death of iconic designer Valentino Garavani and signs of brand dilution (luxury goods appearing at discount retailers like Ross) may have contributed to concerns about luxury brand heritage and pricing power in the market. [253, 257]

Strategic Repositioning Pressures: LVMH's push to reposition Tiffany toward higher-margin gold jewelry and away from silver suggests luxury brands facing pressure to move upmarket amid changing consumer demand patterns. [256]

Accessories EMEA -8.38%

Key Constraints in Luxury Retail Distribution: Major luxury department store Saks Fifth Avenue filed for bankruptcy, indicating significant stress in traditional luxury retail channels that distribute accessories products, potentially reducing sales points and consumer access in EMEA markets. [232]

Increased Off-Price Competition: Off-price retailers like Ross are increasingly sourcing premium brands (Gucci, luxury items), creating downward pricing pressure and channel conflict that may have eroded margins and full-price sales for accessories brands in EMEA. [257]

Shifting Product Category Preferences: Major luxury players like Tiffany & Co. are pivoting away from silver jewelry toward gold and high jewelry due to demand patterns, suggesting weakness in traditional accessories categories that may have contributed to negative returns. [256]

Brand Reputation Risks: Luxury handbag-related scandals (South Korean first lady) and increased competition from new entrants (Byredo leather goods) may have created headwinds for established accessories brands through negative sentiment and market share fragmentation. [211, 225]

Commodities Equity Performance Dashboard

This dashboard provides performance analytics for global equities with exposure to commodities-related themes in Theia Insights Industry Classification (TIIC), grouped by Industry (level two).

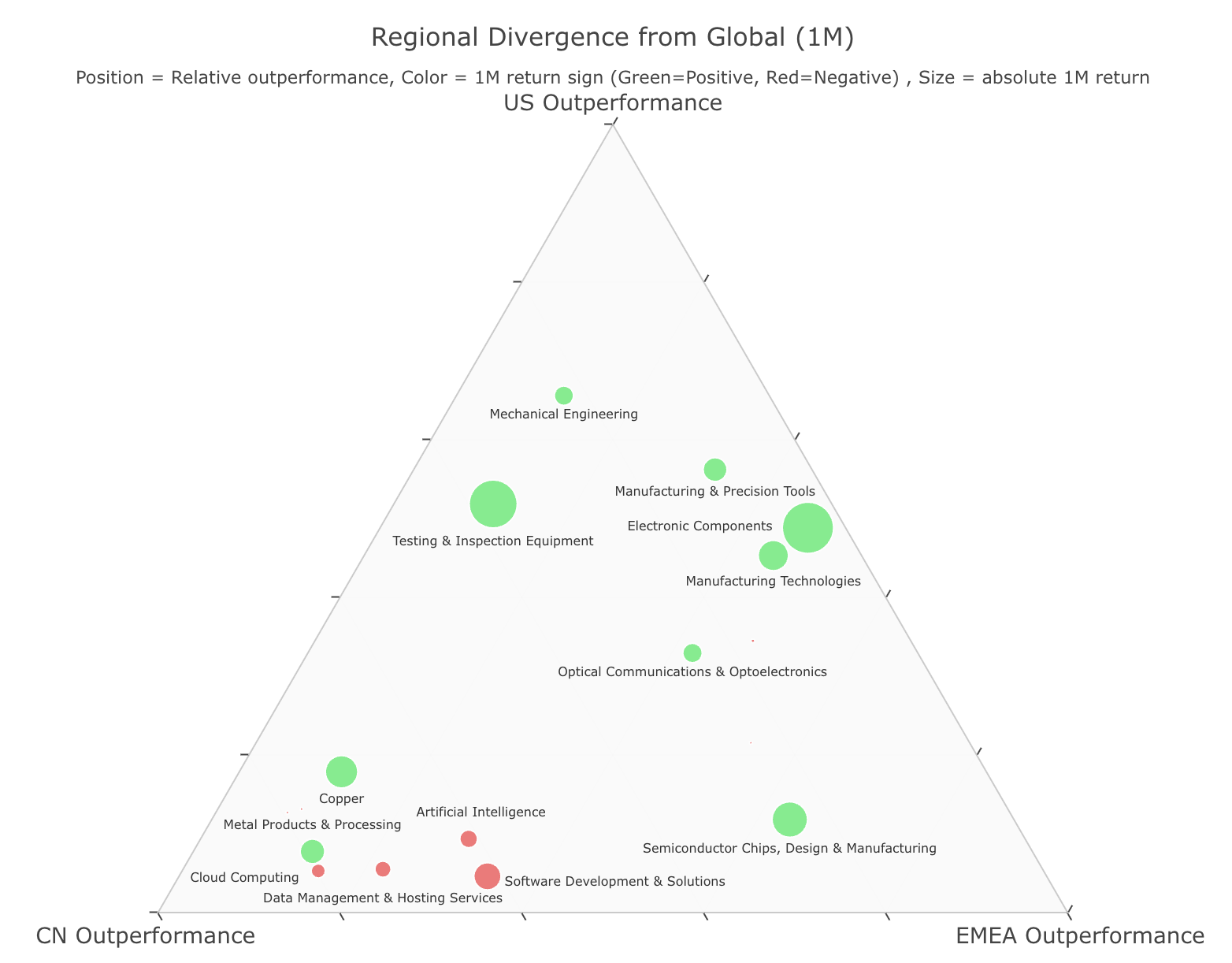

Regional Thematic Performance Overview (Top and Bottom Performing Themes by Region)

This analysis showcases the top three outperforming and underperforming investment themes across major regions, utilising the Theia Insights Industry Classification (TIIC) framework. By examining how identical themes perform differently across geographical markets, this breakdown illuminates the critical impact of regional economic dynamics, regulatory landscapes, and geopolitical developments on thematic investment returns.

Regional Performance Divergence vs Global

Each point's position indicates the relative regional outperformance compared to the global average. The analysis includes tradable portfolios in all three regions, eliminating themes that lack sufficient market presence or liquidity constraints.

Global Sector Thematic Performance (Top and Bottom Performing Themes by Sector)

This dashboard examines thematic investment performance organised by the top-level sectors within the Theia Insights Industry Classification (TIIC) framework. For each sector we report the top 3 and bottom 3 performing themes. By grouping themes under their primary sector classifications, this analysis reveals how broad sectoral trends influence underlying thematic opportunities and risks.

REFERENCES:

[1] Jeff Bezos's grand plan for a satellite constellation to rival SpaceX is coming together [2] SpaceX wants to put 1 million solar-powered data centers into orbit [3] SpaceX seeks FCC nod for solar-powered satellite data centers for AI [4] The first commercial space stations will start orbiting Earth in 2026 [5] US Space Force awards 1st-of-its-kind $52 million contract to deorbit its satellites [6] SpaceX launches 29 Starlink satellites on its 3rd mission of 2026 (video) [7] Rocket Lab launches its 1st mission of 2026, sending 2 satellites to orbit [8] Jeff Bezos’ Blue Origin Announces TeraWave—A Competitor To Elon Musk’s Starlink [9] Seeking independence from Starlink, Japan backs homegrown satellites [10] Rocket Lab's new Neutron rocket suffers fuel tank rupture during test [11] Rocket Lab's 'Hungry Hippo' Neutron fairing arrives at spaceport in Virginia [12] Jeff Bezos' Blue Origin plans to build 5,400-satellite megaconstellation [13] NASA Announces Historic Space Station Evacuation Amid 'Serious' Issue [14] Nasa considers whether to bring sick crew member back to Earth [15] WATCH-Astronauts return to Earth after first-ever medical evacuation from ISS [16] ISS astronaut evacuation shouldn't interfere with upcoming Artemis 2 moon mission, NASA chief says [17] SpaceX capsule with four astronauts, one ailing, splashes down safely off California [18] NASA is performing an unprecedented medical evacuation from the ISS [19] NASA stresses ISS crew safety as it gears up for next astronaut launch [20] NASA's Artemis 2 mission to the moon puts Crew-12 SpaceX launch in delicate dance [21] NASA and SpaceX move up launch of Crew-12 astronauts to Feb. 11 as relief crew after ISS medical evacuation [22] NASA rolls out Artemis II craft ahead of crewed lunar orbit [23] NASA returns humans to deep space after over 50 years with February Artemis II Moon mission [24] After a medical evacuation from space, NASA's Crew-11 returns to Earth a month early [25] SpaceX Crew-11 astronauts return to Earth after 1st-ever medical evacuation of ISS [26] NASA brings Crew-11 home early in rare medical evacuation [27] NASA's Artemis II Moon Mission-How to Watch and What to Know [28] NASA’s historic Artemis II moon mission is almost ready to launch [29] Artemis II-NASA releases potential launch dates for return to moon [30] Blue Origin pauses space tourism flights to focus on lunar lander [31] NASA Commits to Plan to Build a Nuclear Reactor on the Moon by 2030 [32] Moon rush-These private spacecraft will attempt lunar landings in 2026 [33] Fukushima nuclear plant operator to restart reactor at another plant, reviving safety concerns [34] Buy Soaring Uranium Stocks Now and Hold for Home Run Potential [35] The 3 Best Nuclear Energy Stocks to Buy for 2026 [36] Uncle Sam dangles nuclear campuses for states while watering down safety rules [37] Germany's shut down of nuclear plants a 'huge mistake', says Merz [38] Germany's Merz Admits Nuclear Exit Was Strategic Mistake [39] Meta Announces Nuclear Energy Projects, Unlocking Up to 6.6 GW to Power American Leadership in AI Innovation [40] Washington Commits $2.7 Billion to Break Russia’s Grip on Nuclear Fuel [41] Trump and Mid-Atlantic governors want tech companies to pay for new power plants [42] Meta reacts to power needs by signing long-term nuke deals [43] Bill Gates-backed ‘Cowboy Chernobyl’ nuclear reactor races toward approval in Wyoming [44] Meta Will Buy Startup’s Nuclear Fuel in Unusual Deal to Power AI Data Centers [45] Your ChatGPT Habit Could Depend on Nuclear Power [46] Big Tech Bets On Nuclear Power For AI Strategy Edge [47] Trump vows three-week nuclear approvals for tech, sparking market rally [48] Meta signs 3 deals for nuclear energy to power AI data centers [49] A shortage in memory chips is hitting tech hard, and even Apple's not immune [50] Apple reportedly faces critical chip component shortage as AI boom strains supply chain [51] Intel Is 'Going Big Time Into 14A,' Says CEO Lip-Bu Tan [52] CES 2026-Intel Unveils 18A-Based Core Ultra Series 3 Chips Amid Rumors of Future Apple Partnership [53] Get Ready for ASIC Shipments to Triple With This Leading AI Stock [54] Trump places a 25% tariff on high-end computing chips, and said more duties may be coming for the semiconductor industry [55] The US claims it just strongarmed Taiwan into spending $250 billion on American chip manufacturing [56] Semiconductor Wafer Inspection Equipment Market Report 2026-$9.67 Bn Opportunities, Trends, Competitive Landscape, Strategies, and Forecasts, 2020-2025, 2025-2030F, 2035F [57] KLA Corporation (KLAC) Gains Analyst Support as Revenue and EPS Forecasts Rise [58] HTSI gets boost from probe cards and engineering services [59] RBC Sees Multiple Secular and Cyclical Drivers Supporting ASML Upside [60] Non-Destructive Inspection Equipment Industry Research 2026 - Global Market Size, Share, Trends, Opportunities, and Forecasts, 2021-2025 & 2026-2031 [61] Why Bernstein Sees 2026–27 as “Big Years” for ASML [62] $193.78 Bn Artificial Intelligence (AI) Visual Inspection System Global Market Trends, Opportunities and Strategies, 2019-2024, 2025-2029F, 2034F [63] Analysts Turn Bullish on ASML With Price Target Raised to $1,500 [64] ASML executives bet on chip demand strength past 2025 [65] Wafer Fab Equipment Market Report 2026-2030 & 2035 Featuring Profiles of Key Players Hitachi, ASML Holding, Canon, Applied Materials, Komatsu and More - A $132+ Billion Opportunity [66] Atomic Force Microscopy (AFM) Research Report 2026 - Global $707.22 Mn Market Trends, Opportunities, and Forecasts to 2031 [67] Surface Vision and Inspection Research Report 2026-$4.72 Bn Market Opportunities, Trends, Competitive Analysis, Strategies, Forecasts, 2020-2025, 2025-2030F, 2035F [68] Advantest shares jump over 7% after record quarter, lifts profit forecast on AI demand [69] The Death of Software Development [70] Blackstone CTO says entry-level engineers are more talented — but have fewer opportunities to learn on the job [71] Internal messages reveal which teams, jobs affected in Amazon layoffs [72] Are you a software engineer? Tell us what you think about vibe coding [73] Ex-Tesla AI head has seen a 'phase shift in software engineering' using Claude Code — and his manual skills slowly 'atrophy' [74] Anthropic Just Built a Competitor to Meta's $2B Acquisition in 10 Days [75] The 'Godfather of SaaS' says he replaced most of his sales team with AI agents-'We're done with hiring humans' [76] Software Company Bonds Drop As Investors' AI Worries Mount [77] 'Ralph Wiggum' loop prompts Claude to vibe-clone commercial software for $10 an hour [78] Creator of Claude Code Reveals His Workflow [79] Code is cheap. Show me the talk [80] 'AI eats Software'-Warum SaaS-Aktien an der Wall Street crashen [81] Software engineering will be ‘automatable’ in 12 months, says Anthropic CEO Dario Amodei [82] Adobe and other SaaS stocks are taking a beating — as traditional software companies struggle in the AI era [83] Ideas are cheap, execution is cheaper [84] Maine Casino Files Federal Lawsuit To Block iGaming In The State [85] Has sports betting become part of your daily routine? Tell us about it [86] The Microstructure of Wealth Transfer in Prediction Markets [87] They quit their day jobs to bet on current events. A look inside the prediction market mania [88] Fortnite‘s Steal The Brainrot Will Now Subject Millions Of Kids To Grim Microtransactions And Gambling [89] As Fortnite Enables Third-Party Microtransactions, Steal the Brainrot's Developer is Slammed By Fans For Immediately Adding $45 Premium Bundles and Gambling-Style Mechanics [90] The Real Price Of A College Sports Betting Scandal [91] How Tennessee’s Speaker of the House Helped Keep a Payday Lender’s Struggling Sports Gambling Company Alive [92] Dell, Intel, DraftKings-Top analyst calls today [93] Hochul’s gambling addiction plan blasted as hypocrisy — as NYS readies for more casinos [94] America Is Slow-Walking Into a Polymarket Disaster [95] The Hidden Tax Battle Behind America’s $50B Prediction Markets Boom [96] On Tilt [97] Hochul takes aim at AI social media chatbots, online gambling in latest kid-protection moves [98] AI Boosts Research Careers But Flattens Scientific Discovery [99] Why Wall Street's most data-obsessed investors are taking it slowly with generative AI [100] Half of developers think gen AI is bad for the gaming industry [101] Artificial intelligence tools expand scientists’ impact but contract science’s focus [102] The Math on AI Agents Doesn’t Add Up [103] Training large language models on narrow tasks can lead to broad misalignment [104] Researchers tested AI against 100,000 humans on creativity [105] Hundreds of creatives warn against an AI slop future [106] AI Has Made Hiring Worse—But It Can Still Help [107] Science Is Drowning in AI Slop [108] All the ways TikTok is broken-here’s what’s real and what’s not [109] Intel Struggles To Meet AI Data Center Demand [110] Microsoft scrambles to quell fury around its new AI data centers [111] TikTok says a power outage messed up its algorithm over the weekend [112] Wall Street is losing its appetite for Oracle's data center debt [113] Meta and Microsoft both blew their data center budgets last quarter. Wall Street is only mad at one of them. [114] TikTok blames its US problems on a power outage [115] Intel struggles to meet AI data center demand, shares drop 13% [116] Intel stock rises on analyst upgrade citing data center AI demand, 'significant progress' in manufacturing [117] The winter storm tested power grids straining to accommodate AI data centers [118] Microsoft claims "Community First" AI data center infrastructure — also known as maximum corpo-washing [119] Microsoft is in hot water for, well ... water abuse — data center water use expected 'to more than double' by 2030 [120] Utilities want $31 billion more from customers, and your electric bill is about to feel it [121] 電気代267%値上がりしんど…データセンター建設の反対運動、アメリカで急増のワケ [122] Prediction-These 4 Quantum Computing Stocks Will Skyrocket in 2026 [123] Quantum Computing Stocks IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. Have Served Up an $840 Million Warning for Wall Street [124] A $550 Million Reason to Buy This Quantum Computing Stock Now [125] IonQ Stock Prediction-Here's Where the Quantum Computing Play Will Be in 1 Year [126] A Once-in-a-Decade Investment Opportunity-3 Quantum Computing Stocks to Buy and Hold [127] Some quantum computers might need more power than supercomputers [128] Unbreakable? Researchers warn quantum computers have serious security flaws [129] Quantum computing firm IonQ acquires US semiconductor firm SkyWater for $1.8 billion [130] RGTI and QUBT-This Analyst Sees the Next Jump in Quantum Stocks [131] 3 Quantum Computing Stocks That Could Make a Millionaire [132] Better Quantum Stock-Rigetti Computing vs. Quantum Computing [133] Will Quantum Computing Stocks Become the AI Stocks of 2026? [134] Rosenblatt Initiates Coverage of Quantum Computing (QUBT) Stock [135] IonQ (IONQ) Stock Is Down 50%. Is This Quantum Computing Stock a Buy? [136] Photonic raises $130M to scale quantum computers with entanglement-based networking [137] D-Wave Files $330 Million Shel-Growth Fuel or Dilution Risk? [138] After Rigetti Announced a Quantum Computing Delay, How Should You Play RGTI Stock in January 2026? [139] The Simple Reason Why I Won't Buy Quantum Computing Stocks in 2026 [140] Here's Why I Wouldn't Touch Quantum Computing Stock With a 10-Foot Pole [141] This THC beverage took off as people drank less alcohol. Now it could disappear. [142] Smoke and Mirrors-How Intoxicating Hemp Seeped Into the First Recreational Marijuana Market in the Country [143] We Tested Vapes in Colorado for Signs of Hemp. This Is What We Found. [144] MSOS ETF Drops 26% in One Month as Federal Cannabis Policy Stalls [145] Neue Schmuggelroute-Warum finden Zollbeamte so viel Cannabis aus Amerika? [146] Cannabis-linked vomiting syndrome skyrockets among young adults, study warns [147] Cannabis was touted for nerve pain. The evidence falls short [148] Multiple States Facing Marijuana Legalization Repeal Threats in 2026 [149] Cannabisschmuggel-Donald Trump, der Drogenpräsident [150] 'Out of stock'-What went wrong at luxury retailer Saks? [151] India to unveil incentives for lithium, nickel processing, sources say [152] Nickel Edges Higher as Traders Shrug Off Rising Inventories [153] Aluminium, Kupfer, Nickel-Warum Industriemetalle so teuer sind [154] China’s Metals Markets Surge on Bullish Outlooks [155] Indonesia cuts nickel mining quota to support prices, imports needed in 2026 [156] Andrew Forrest has sunk $760m into these nickel mines. Will they ever reopen? [157] Canada Nickel appoints Ausenco for Crawford project [158] Indonesia Coal Market Analysis Report 2026 | Shares, Industry Trends & Statistics, Growth Forecasts to 2031 | Mandatory DMO Price Caps Challenge Investment in Indonesia's Coal Sector [159] Copper, AI & America's Supply Risk [160] More worrying tech supply chain news - no, it's not more RAM troubles, but this vital material could be set to cause issues sooner than expected [161] Amazon digs deep for AI gold as copper mine partnership fuels massive data center expansion [162] AWS signs mega deal with Rio Tinto for the first new copper mine in the US for years - here's what it could do with that windfall [163] Copper is tumbling from record highs. Why one top bank thinks a larger correction could be looming. [164] Copper hits record $13,000 as US import rush fires up bulls [165] An Alaskan mine that's been in political limbo for years might be the key to satisfying America's huge appetite for copper [166] One eye-popping prediction shows why copper prices could continue to surge for years to come [167] Copper prices settle at a record high as metals are going ‘absolutely bonkers’ right now [168] Copper Surges to Fresh Record as Inventories ‘Locked in the US’ [169] The future depends on copper, but a coming shortage makes it a ‘systemic risk’ to the economy and a strategic flashpoint, S&P Global warns [170] Hindustan Copper shares gain 10% in three trading sessions. What should investors do in 2026? [171] BHP CEO Says Copper Demand Is 'Ubiquitous' [172] Copper climbs to record high above $13,000 after strike at Chilean mine [173] Industrial demand is driving copper prices to record highs, but a shortfall and economic trouble loom [174] Copper hits record high amid concern about physical demand [175] World will need 50% more copper than we have today-S&P Global's Yergin [176] Tech billionaire Prateek Suri describes Africa’s gold as next global asset [177] Trump says that Microsoft will 'ensure' Americans don't 'pick up the tab' for its data center power consumption [178] Data centers power Blackstone's $1.3 trillion investment empire [179] Mark Zuckerberg says Meta will build 'hundreds of gigawatts' of AI capacity over time [180] Bloom Energy Fuels AI Data Center Power With US$2.65b Deal [181] Nvidia is buying more CoreWeave stock — this time it's in for $2 billion [182] Meta Signs Multi-Gigawatt Nuclear Deals to Power AI Data Centers [183] There's no such thing as 'free lunch' for Big Tech's electric bill [184] US Carbon Pollution Rose In 2025, a Reversal From Prior Years [185] U.S. Greenhouse Gas Emissions Are Rising for the First Time in Two Years—They Could Climb Far Higher [186] Ethereum to $40,000? Why one analyst expects the second-biggest crypto to outperform Bitcoin [187] Bitcoin and broader crypto markets 'have bottomed,' Bernstein analysts say [188] CZ Predicts Bitcoin ‘Super-Cycle’ in 2026, Breaking Historic Pattern [189] Bitcoin Open Interest Crashes to Lowest Since 2022, Signaling Reset [190] BitGo Holdings prices US IPO at $18, Bloomberg News reports [191] Cathie Wood’s ARK Invest Makes Bold Bitcoin and Nvidia Prediction [192] Bernstein says bitcoin has likely bottomed, reveals price targets [193] Bitcoin Price Finally Breaks from a 6-Week Bear Pattern, What’s Next? [194] Bitcoin Stays Above $95,000, But the Real Test Begins Now [195] Fidelity Investments Starts its own stablecoin in a massive bet that future of banking is on blockchain [196] Bitcoin Open Interest Drops 31% as Analysts Call a Market Bottom and Eye $105k Breakout [197] Fidelity Launches FIDD Stablecoin on Ethereum, Joining Race Under US Stablecoin Law [198] Citi says CLARITY Act momentum builds, but DeFi fight could stall crypto bill [199] Market structure bill delay seen capping U.S. crypto valuations, Benchmark says [200] Ethereum Gains Wall Street Adoption as $6T Fidelity Prepares FIDD Stablecoin Launch [201] BlackRock’s Bitcoin ETF Sees Biggest Inflow in Three Months as Crypto Prices Rise [202] Bitcoin price falls as BlackRock and Fidelity ETFs see heavy outflows [203] Bitcoin Bull Market Starts With a 4.5% Move? History and Charts Finally Align [204] Bitcoin rebounds from one-month low while derivatives flash near-term stress-Crypto Markets Today [205] 'Sell America' has sparked a FOMO-fueled rush to gold and silver among everyday investors [206] Gold tops $5,000, silver soars as 'breathtaking and profoundly scary' rally continues [207] Gold tumbles to $4,900, silver crashes 25% as precious metals trade unwinds [208] Saks Global files for bankruptcy after Neiman Marcus takeover leads to financial collapse [209] Legendary Luxury Retailer Saks Needs a New Start. It's Looking for 'Long-Term Potential' [210] Bernard Arnault’s Fortune Drops By $12.5 Billion After Trump’s 200% Tariff Threat Against French Wines [211] You've Seen Byredo's Candles. But Not Byredo's Antelope Leather Handbags [212] BofA details its top 3 stock picks in the red-hot metals sector [213] Here’s everything investors need to know about the historic silver rally in 10 charts [214] Jim Cramer Considers Pan American Silver the “Best Silver Mining Company” [215] Silver finally hits $100 an ounce — and some experts say that’s just the beginning [216] Metals outlook brightens on global cues; Trent faces near-term headwinds-Siddhartha Khemka [217] Gold Surges Past Record $5,100–Silver Rises More Than 8% [218] Gold and silver prices hit high after tariff threat [219] RBC Capital Elevates Wheaton Precious Metals Corp. (WPM) to Outperform [220] Dollar Retreats and Precious Metals Surge to Record Highs [221] Gold And Silver Hit Record Highs Amid U.S.-Europe Tension Over Greenland [222] Precious metals crash, with silver plunging 35%, gold 12%; bitcoin holds at $83,000 [223] Scotiabank, Citi, and Raymond James Raise Newmont (NEM) Price Targets [224] Dollar Falls and Precious Metals Surge on Concerns Over Fed Independence [225] A string of scandals and luxury handbags-Who is South Korea's former first lady? [226] Dollar Falls to 4-Month Low and Precious Metals Surge to Record Highs [227] Dollar Slips as the Yen Recovers and Precious Metals Soar on Geopolitical Risks [228] H.C. Wainwright Increases PT on Endeavour Silver Corp. From $11 to $14.50, Keeps Buy Rating [229] Silver Surges To Record $120, Gold Nears High Of $5,600 As Price Rally Breaks Even More Records [230] Here’s What Needs to Happen for Silver to Reach $100 in 2026 [231] Silver Breaks Milestone $100 For The First Time As Gold Nears $5,000 [232] I went to Saks Fifth Avenue to see why the iconic department store was struggling. Hours later, it filed for bankruptcy [233] Jim Cramer on Agnico Eagle-“They’re the Best Miner” [234] The Journey of Finding the Right Press Brake [235] Apple's Foldable iPhone Rumored to Be Built With Liquid Metal and Improved Titanium [236] Laser Etching Colors Onto Metal [237] MetalPrinting Gauss MT90 3D printer offers office‑safe metal printing without powders — uses paste based metal extrusion (PME) tech [238] Dawson Knives balances automation & tradition to sustain American manufacturing amid economic turmoil [239] Robust minimally-invasive microfabricated stainless steel neural interfaces for high resolution recording [240] Bosch Pro Dealer Conference-Gia công kim loại và dây chuyền lắp ráp thông minh [241] Amazon expected to cut thousands more corporate jobs soon [242] Ubisoft just killed its Halifax studio right after it unionized, but says the shutdown was decided "well before" — over 70 developers have been affected [243] Nike plans to cut 775 employees in a push to accelerate automation [244] AI may be everywhere, but it's nowhere in recent productivity statistics [245] RBC Cuts UiPath (PATH) PT to $17 Highlighting 2026 as a Year of Divergence for Software Sector [246] Indian top IT firms set for another tepid quarter on weak US demand, client spending [247] Amazon Announces 16,000 Job Cuts to Streamline Operations [248] Experiment suggests AI chatbot would save insurance agents a whopping 3 minutes a day [249] ServiceNow stock falls despite earnings beat as CEO Bill McDermott tries to get investors to stop thinking of it as a SaaS company [250] Microsoft reportedly eyeing massive January layoffs — but the "AI obsession" shows no signs of slowing [251] Who is Winning AI Workflow Automation? We Compared 4 Enterprise Stocks. [252] AI hasn't delivered the profits it was hyped for, says Deloitte [253] Italian fashion designer Valentino dies at 93 [254] Saks owes hundreds of millions to luxury brands from Chanel to Burberry [255] Luxury retail giant Saks files for bankruptcy [256] Tiffany & Co. is setting its sights on the gold girlies [257] Ross is stocking up on brands like Gucci and Hoka — and it's luring shoppers on the hunt for a dealGet In Contact

press@theiainsights.comAbout Theia Insights

Theia Insights is a deep tech company based in Cambridge (UK), building foundational AI for the global investment community. We are a team of PhD scientists, engineers, mathematicians, and industry practitioners offering clients future-proof solutions in Industry Classification, Thematic Risk Models, and Portfolio Analytics. Named after the goddess of sight, Theia synthesises and distils vast amounts of financial information so investors can see more clearly. To learn more, visit www.theiainsights.com.